What Are Liquid Mutual Funds? Complete Guide to Low-Risk Short-Term Investing

What Are Liquid Mutual Funds? Complete Guide to Low-Risk Short-Term Investing

Your savings account earns 0.5% while inflation runs 3-4% annually. You're losing purchasing power every month. Liquid mutual funds offer superior alternative delivering 4.5-5.5% returns with comparable safety and instant access.

These debt instruments invest in money market securities with 91-day maximum maturity. Liquid funds provide three core advantages: superior returns versus traditional savings, very low risk through AAA/AA+ rated securities, and T+1 settlement liquidity. This guide explores benefits, return mechanics, and fund selection criteria.

What Are Liquid Mutual Funds?

Liquid mutual funds are debt funds investing in short-term money market instruments with 91-day maximum maturity per security. Average portfolio maturity ranges 30-45 days. Portfolio includes Treasury bills (20-40%), commercial paper (20-40%), certificates of deposit (10-30%), and repo agreements (10-30%).

SEC Rule 2a-7 provides a regulatory framework. The 91-day maturity cap prevents excessive interest rate risk. Regulations require AA+ minimum credit ratings. Quality funds maintain 80%+ AAA securities.

Think of liquid funds as a parking spot for your cash. Safer than regular savings. More accessible than locked CDs. An investor with a $50,000 surplus awaiting home purchase in 3 months represents an ideal use case.

Minimum investment ranges $500-$3,000. NAV (Net Asset Value) represents per-unit price calculated daily. Example: invest $10,000 at NAV $100 equals 100 units. NAV rises to $101. Your holding grows proportionally.

Redemption provides funds T+1 (next business day). NAV updates daily on fund websites ensuring transparency.

Key Benefits of Liquid Mutual Funds

Liquid mutual funds deliver six distinct advantages making them superior to traditional savings for short-term cash management.

Liquid mutual funds deliver six distinct advantages making them superior to traditional savings for short-term cash management.

High Liquidity

T+1 settlement provides next-business-day access. Many platforms offer instant redemption up to $50,000. CDs impose a 3-6 months interest penalty for early withdrawal.

Better Returns

Current yields range 4.5-5.5% annually versus 0.5-1% regular savings. Example: $100,000 at 5% generates $5,000 yearly. Regular savings produces $500. Difference reaches $4,500 annually.

Very Low Risk

AAA/AA+ credit rating requirement creates the highest-quality portfolio. Annual volatility 0.1-0.3% versus equity funds 15-20%. Default probability under 0.1% for AAA securities.

Portfolio spreads across 20-50 issuers including US Treasury, major banks, and top corporations. Credit ratings from Moody's, S&P, and Fitch provide objective assessment.

No Lock-in Period

Exit load waived after 7 days. CDs lock funds until maturity. Liquid funds allow withdrawal anytime.

Low Minimum Investment

Entry threshold $500-$3,000 makes funds accessible to most investors.

Tax Efficiency

Gains taxed at redemption rather than annually. Potential long-term capital gains treatment (15-20%) versus ordinary income (up to 37% federal).

Understanding Liquid Fund Returns

Liquid funds deliver 4.5-5.5% annually in the current 2024-2025 environment. Federal funds rate stands 4.75-5.00%. Regular savings offer 0.5-1%.

Return mechanism: Fund invests in money market instruments earning yield. Yield accrues daily. NAV increases reflecting income. Your units grow proportionally.

Daily accrual differs from savings crediting quarterly. Compounding effect accelerates growth through daily NAV increases.

Expense ratio impacts net returns. Gross returns minus expense ratio (0.10-0.35%) equals net returns. Example: $100,000 at 5.0% gross minus 0.20% expense equals 4.8% net. After one year: $104,800 versus savings $100,750. Difference $4,050.

Four return drivers: Federal funds rate influences yields within 1-2 months. Portfolio credit quality affects yields. Expense ratio creates direct impact. Market liquidity influences yields temporarily during stress.

Historical context: 5.0-5.5% (2023-2024), 0.5-1.5% (2020-2021). Returns track Fed policy with 1-2 month lag.

Taxation of Liquid Mutual Funds

Most money market and liquid funds distribute ordinary income taxed at a marginal rate. Federal brackets range 10-37%.

Example: investor in 24% federal plus 5% state (29% combined) with $5,000 gain pays $1,450 tax.

Some funds qualify for capital gains treatment. Short-term (under 1 year) taxed as ordinary income. Long-term (1+ years) at preferential 15-20% rates plus 3.8% NIIT for high earners.

Scenario: $100,000 invested 18 months grows to $107,500 ($7,500 gain). Ordinary income: $7,500 × 29% equals $2,175 tax. Long-term capital gains: $7,500 × 18.8% equals $1,410 tax. Savings $765.

Verify prospectus for distribution classification. Liquid funds' higher gross returns often produce superior after-tax returns versus savings and CDs even with ordinary income treatment.

Tax Efficiency Compared to CDs

Investor in 29% bracket comparing 2-year investment at 5.0% gross.

CD: interest taxed annually at 29% producing net 3.55%. $50,000 grows to $53,614.

Liquid fund (LTCG qualified): no annual tax with gains at redemption 18.8% producing net 4.0%. Grows to $54,100 creating $486 advantage.

Key advantages: Tax deferral, potential LTCG treatment, no automatic withholding, 1099 timing control.

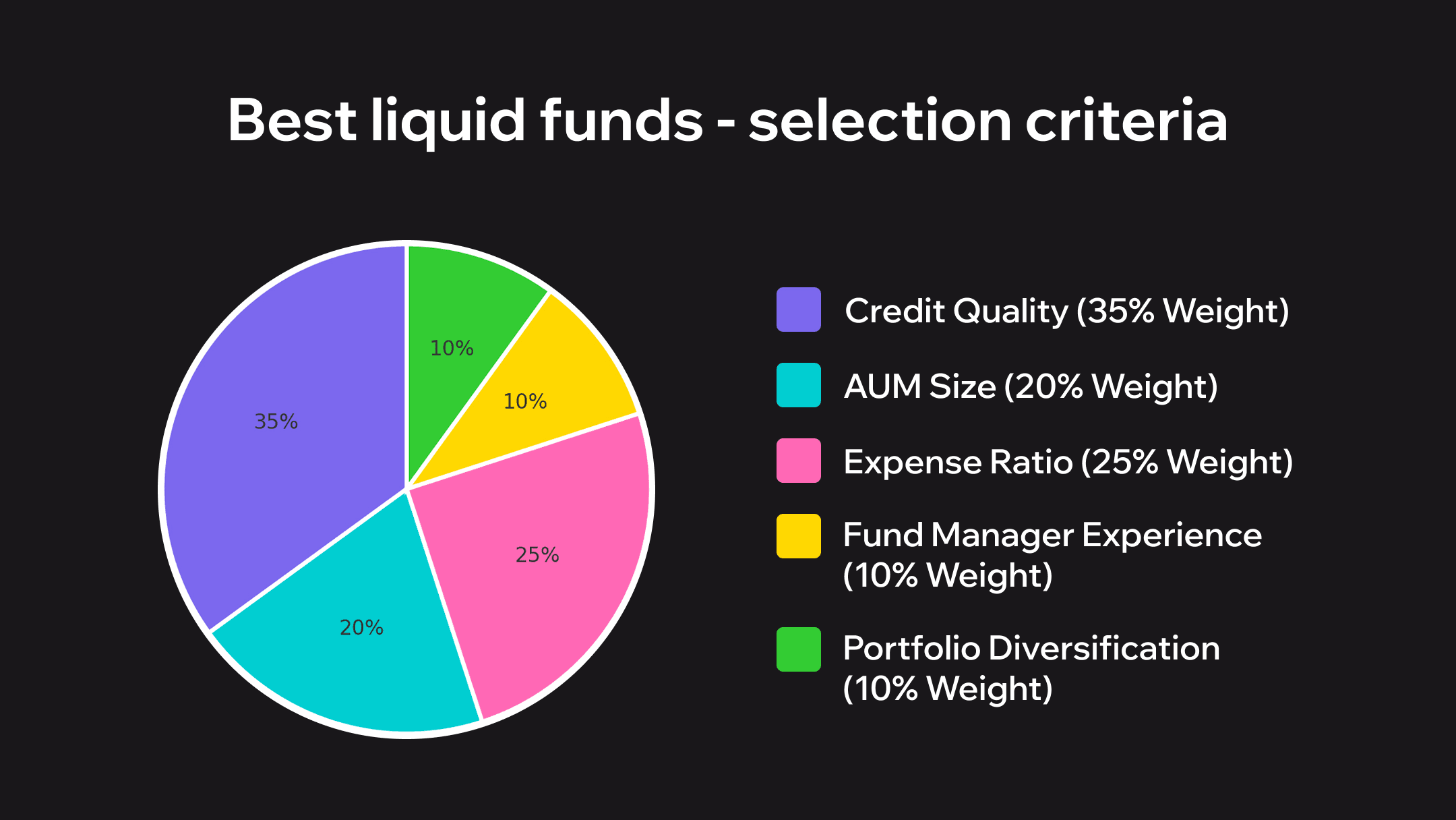

Best Liquid Funds - Selection Criteria

Five evaluation factors guide fund selection.

Five evaluation factors guide fund selection.

Factor 1 - Credit Quality (35% Weight)

Target 85-90% AAA-rated securities. Check government allocation where 40%+ indicates ultra-conservative approach. Verify no holdings below AA+. Access via fund prospectus or SEC EDGAR.

Factor 2 - AUM Size (20% Weight)

Prefer $500 million+ for operational efficiency. Optimal $1-20 billion. Avoid under $100 million.

Factor 3 - Expense Ratio (25% Weight)

Excellent: under 0.10%. Good: 0.10-0.20%. Average: 0.20-0.30%. High: over 0.30%. Target under 0.25%.

Factor 4 - Fund Manager Experience (10% Weight)

Prefer 5+ years managing liquid funds. Track record across rate cycles matters. Major providers: Vanguard, Fidelity, Schwab, BlackRock, JPMorgan.

Factor 5 - Portfolio Diversification (10% Weight)

Balance across instrument types. No single non-government issuer over 5-10%. Weighted average maturity 30-50 days.

Implementation: shortlist 5-7 funds, gather prospectuses, score on 5 factors, select top 2-3.

Evaluating Credit Quality

Access prospectus from fund website or SEC EDGAR. Locate Portfolio Holdings listing securities with ratings. Calculate AAA percentage by summing AAA securities divided by total. Target minimum 85%.

Assess government securities allocation. Above 40% indicates maximum safety. Review commercial paper issuers. Check for below-AA+ holdings.

Example: Fund A shows 92% AAA, 35% government, zero below AA+. Fund B shows 78% AAA, 15% government, 5% A+. Fund A superior.

Major categories: Government funds (95-100% US government, expense under 0.15%, yields 0.1-0.2% below prime). Prime funds (85-95% AAA, expense 0.10-0.25%, yields 0.1-0.3% above government).

Understanding Expense Ratios

Expense ratio represents annual fee covering operations. Direct impact: gross return minus expense ratio equals net return.

Example: Two funds earning 5.0% gross. Fund X 0.10% expense (4.90% net). Fund Y 0.30% expense (4.70% net). On $100,000 difference $200 yearly, $1,000 over 5 years.

Share classes: Institutional (0.05-0.15%, high minimums). Admiral/select (0.10-0.20%, $3k-$50k minimum). Retail (0.20-0.35%, $500-$3k minimum).

Choose the lowest expense class you qualify for.

Liquid Funds vs Other Investment Options

Choose high-yield savings for daily access, immediate emergency buffer, under $10,000, FDIC priority.

Choose high-yield savings for daily access, immediate emergency buffer, under $10,000, FDIC priority.

Choose liquid funds for parking 1-6 months, emergency beyond buffer, over $10,000, comfortable with AAA securities.

Choose CD for term commitment, guaranteed rate, FDIC essential.

Choose a money market account for yields plus transactions, ongoing cash management.

When to Choose Liquid Funds Over CDs

Choose liquid funds when: Uncertain timeline makes CD penalty costly. Need partial access. Short duration under 3 months. Building an emergency fund. No FDIC requirement.

Stick with CDs when: Committing to a fixed term. FDIC essential. Prefer guaranteed locked rate. Building a CD ladder.

Risks and Limitations of Liquid Funds

Three primary risks exist:

Credit Risk: Issuer defaulting on payment. AAA default probability under 0.1% annually. Mitigated through AA+ minimum, diversification across 20-50 issuers.

Interest Rate Risk: Rate changes affecting values. Modified duration 0.1-0.3 years means 100bp rate change creates 0.1-0.3% NAV impact. Short maturity limits sensitivity.

Market Liquidity Risk: During severe stress liquidity can evaporate. SEC Rule 2a-7 requires 10% daily liquid assets, 30% weekly. Fund boards can impose redemption fees during stress (rarely used).

Key Limitation: No FDIC insurance unlike savings and CDs. Compensated by SEC regulation, AAA/AA+ quality, professional management.

Ideal Use Cases for Liquid Funds

Four scenarios demonstrate optimal applications:

Use Case 1 - Emergency Fund Beyond Buffer: Maintain 3-6 months expenses beyond 1-month in savings. Example: $5,000 monthly expenses keeps $5,000 in savings, $25,000 in liquid fund. Returns 4.5-5.5% annually versus savings 0.5%.

Use Case 2 - Short-term Goal Parking: $8,000 insurance premium in 4 months. $40,000 down payment in 3-6 months.

Use Case 3 - Pre-Investment Staging: Dollar-cost averaging bridge. $120,000 windfall investing $10,000 monthly.

Use Case 4 - Surplus Cash Management: $30,000 bonus awaiting allocation. $75,000 business seasonal surplus.

Liquid funds serve as parking tools for 1-6 month timeframes exclusively. Not for long-term wealth creation.

How to Invest in Liquid Funds

Seven-step implementation guide:

Step 1 - Open Brokerage Account: Choose major brokerages (Vanguard, Fidelity, Schwab) for proprietary funds with lowest expense ratios 0.08-0.15%. Required: SSN/TIN, government ID, address proof, bank info. Timeline: 15-30 minutes online, approved 1-2 days.

Step 2 - Link Bank Account: Connect via ACH. Verification 1-3 days or instant via Plaid.

Step 3 - Research Funds: Apply five-factor criteria. Compare 3-5 funds using Morningstar. Check minimums $500-$3,000.

Step 4 - Make Investment: Enter ticker, choose amount, select settlement (ACH 1-3 days). Orders before 4 PM ET get same-day NAV.

Step 5 - Set Automatic Investments: Configure recurring purchases weekly or monthly.

Step 6 - Monitor: Units allotted 1-2 days after settlement. NAV updates daily.

Step 7 - Redemption: Submit sell order. Funds transfer ACH T+1 (1-2 days). Some platforms offer instant to $50,000.

Enhancing Your Financial Strategy Beyond Cash Management

While liquid funds excel at preserving capital and maintaining liquidity for your short-term needs, building true wealth requires diversifying across multiple strategies. Once you've established your emergency fund foundation in liquid instruments, consider exploring active trading opportunities.

Visit Upscale.trade for professional trading infrastructure. Pass our two-phase evaluation challenge and access funded capital up to $200,000 with an 80/20 profit split. Our platform enforces institutional-grade risk management including 5% daily drawdown and 10% total drawdown limits to protect both your discipline and our capital.

Smart capital allocation extends beyond parking funds. Discover how Upscale's prop trading platform can complement your investment strategy with funded accounts and professional trading infrastructure across 200+ instruments. Strategic trading opportunities in crypto and prop trading markets offer calculated growth potential.

Conclusion – When Liquid Funds Make Sense

Three pillars support liquid fund value:

Benefits deliver superior returns versus savings with 3-4 percentage point advantage. T+1 settlement with instant redemption to $50,000. Very low risk through AAA/AA+ portfolio.

Returns provide daily accrual with compounding. Current 4.5-5.5% yields versus 0.5-1% savings.

Selection focuses on credit quality (85%+ AAA), expense ratio (under 0.25%), AUM ($500M+). Use major providers: Vanguard, Fidelity, Schwab.

Ideal for 1-6 month cash parking. Emergency fund beyond immediate buffer (1 month savings, 2-5 months liquid fund). Short-term goals, surplus management, pre-investment staging.

Actionable steps: Calculate emergency fund (3-6 months expenses). Open brokerage if needed. Research 3-5 funds. Start with a portion to gain comfort. Scale up maintaining a 1 month savings buffer.

Liquid funds democratize sophisticated cash management. Accessible with $500-$1,000 minimums. Smart cash management is the first step in a comprehensive financial plan.

FAQ

What is the 7-5-3-1 rule in mutual funds?

Investment time horizon framework suggesting different asset allocations based on investment duration. The rule recommends equity funds for 7+ year goals, balanced funds for 5+ years, debt funds for 3+ years, and liquid funds for 1 year or less. Liquid mutual funds fit the "1" category — ideal for shortest duration parking where capital preservation and liquidity matter most.

What are the disadvantages of liquid mutual funds?

Three primary risks exist: (1) Credit risk — possibility of issuer default, though minimal with AAA/AA+ ratings (under 0.1% default probability annually). (2) Interest rate risk — rate changes affect security values, but modified duration of 0.1-0.3 years limits impact to 0.1-0.3% NAV change per 100bp rate move. (3) No FDIC insurance unlike savings accounts and CDs. Additionally, lower returns versus equity funds over long periods — liquid funds deliver 4-5% while stocks average 10%+ historically, making them unsuitable for long-term wealth building.

How are liquid mutual funds taxed?

Most liquid funds are taxed as ordinary income at your marginal tax rate (10-37% federal brackets), similar to CD interest. Some funds may qualify for capital gains treatment: short-term gains (under 1 year) taxed as ordinary income, long-term gains (1+ years) at preferential 15-20% rates plus 3.8% net investment income tax for high earners. Verify specific fund's tax classification in prospectus — most retail money market funds distribute ordinary income. Government money market funds may offer state tax exemption on federal securities.

Which is the safest liquid fund?

Government money market funds investing 95-100% in US Treasury bills and government securities offer highest safety with virtually zero credit risk. Look for funds with: (1) 90%+ AAA-rated portfolio, (2) High government securities allocation (40%+ of portfolio), (3) Low expense ratio under 0.15%, (4) Large AUM over $1 billion indicating stability, (5) Established provider like Vanguard, Fidelity, or Schwab. Major providers' government money market funds meet these criteria. Trade-off: yields typically 0.1-0.2% lower than prime funds investing in corporate securities.

Are liquid funds good for beginners?

Yes — ideal starting point for beginners due to: (1) Low risk through AAA/AA+ credit ratings and short 91-day maximum maturity limiting interest rate sensitivity, (2) High liquidity with T+1 redemption providing quick access to funds unlike locked CDs, (3) Low minimum investment of $500-$3,000 making them accessible without large capital, (4) Simple mechanics — invest and earn daily returns automatically without active management required, (5) Superior returns to savings accounts (currently 4-5% vs 0.5-1%) teaching value of optimizing cash. Perfect for building emergency funds and learning investment basics before progressing to stocks/bonds.