Primary Market vs. Secondary Market: What's the Difference?

Primary vs Secondary Market: Key Differences Explained

Financial markets drive global economy growth. Understanding primary market and secondary market differences unlocks trading success. Master these concepts for profitable investment decisions.

Understanding Capital Markets: The Foundation of Successful Trading

Capital markets connect money with opportunity. Primary market and secondary market work together seamlessly. Smart traders understand both systems completely.

Think of capital markets like a massive machine. Primary market creates new financial instruments. Secondary market trades existing ones. Each serves different purposes in economic growth.

Modern prop trading requires market knowledge. Successful traders study market structures deeply. Risk management improves with better understanding. Professional trading platforms leverage both markets effectively.

Cryptocurrency markets follow similar patterns. New tokens launch through primary market processes. Established coins trade on secondary market exchanges. The same principles apply across all assets.

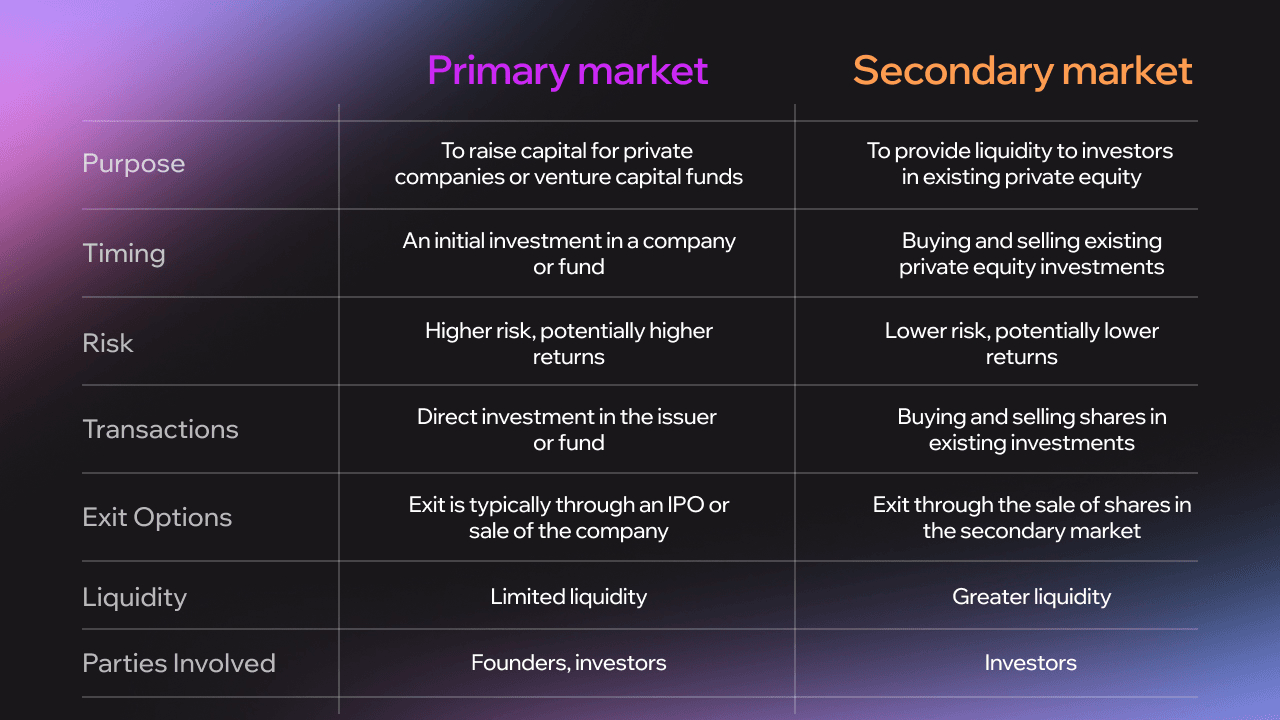

The Fundamental Difference Between Primary Market and Secondary Market

Primary market creates wealth. Secondary market transfers it. The difference between primary and secondary markets determines investment strategy.

Picture a car factory. Primary market builds new cars. Secondary market sells used ones. Both serve essential economic functions. Neither works alone effectively.

Primary market participants include issuing companies and initial investors. Secondary market involves all subsequent trading activity. Money flows differently in each system.

Professional trading platforms focus mainly on secondary market activity. Established assets offer better liquidity. Risk profiles suit funded account trading. Price discovery happens more efficiently.

What is Primary Market? The Birthplace of Financial Assets

What is the primary market exactly? Where new securities are issued to the public for the first time. Companies and governments raise capital here directly.

Primary market is where new securities begin their journey. Initial public offering launches happen here. Private placement deals occur here. Companies to raise funds use primary market channels.

New stocks and bonds enter circulation through primary market processes. Investors for the first time purchase securities directly from issuing companies. No secondary trading exists yet.

Primary market provides capital formation for businesses. Innovation funding flows through these channels. Startups access growth capital here. Economic growth depends on healthy primary markets.

What is Secondary Market in Modern Trading

Secondary market is where investors buy and sell existing securities. Previously issued shares trade among investors continuously. Stock exchange platforms facilitate these transactions.

Secondary market is one massive trading network. Buyers and sellers meet electronically. Price discovery happens through supply and demand. Liquidity makes secondary market trading possible.

Trading on the secondary market generates no new capital. Money moves between investors only. Companies receive no additional funding. Market participants trade for profit or portfolio management.

Investors trade existing shares daily. Market allows continuous buying and selling. Stock exchanges like NYSE facilitate transactions. Secondary market provides investment flexibility.

Features of Primary Market That Traders Should Know

Primary market characteristics shape investment opportunities. Understanding these features helps trading decisions. Professional analysis requires this knowledge foundation.

Key primary market features include:

- Direct securities purchase from issuer

- Fixed issue price for all buyers

- Limited time offering windows

- Regulatory approval requirements

- Underwriting support for companies

- Price discovery through book building

Primary market refers to controlled distribution. Allocation methods vary by offering type. Due diligence requirements are extensive. Smart contracts revolutionize modern primary market mechanics.

New securities are issued following strict procedures. Securities and exchange board oversight ensures fairness. Market participants must meet qualification standards. Primary market provides structured capital access.

Functions of Primary Market in the Modern Economy

Functions of the primary market drive economic progress. Capital formation enables business expansion. Innovation funding supports technological advancement. Primary markets create tomorrow's trading opportunities.

Primary market provides direct investor access to new ventures. Companies to sell shares raise expansion capital. Long-term bonds on the primary market fund infrastructure projects. Economic growth accelerates through efficient capital allocation.

Types of Primary Market Offerings in Modern Markets

Different offering methods serve various business needs. Each type creates unique trading opportunities later. Understanding these differences improves secondary market analysis.

Initial public offering brings companies public for the first time. Private placement targets qualified investors only. Modern token sales use blockchain technology. Each method affects subsequent secondary market performance.

Public for the first time offerings require extensive documentation. Securities and exchange commission approval takes months. Private deals close faster but limit investor access. Modern offerings blend traditional and digital approaches.

Navigating the Secondary Market: A Prop Trader's Perspective

Secondary market operations define daily trading reality. Professional traders focus primarily here. Established assets provide optimal risk-reward profiles for funded accounts.

Market participants include institutions and individual investors. Buyers and sellers interact continuously. Stock exchanges like NYSE and NASDAQ facilitate trades. Price discovery reflects real-time market sentiment.

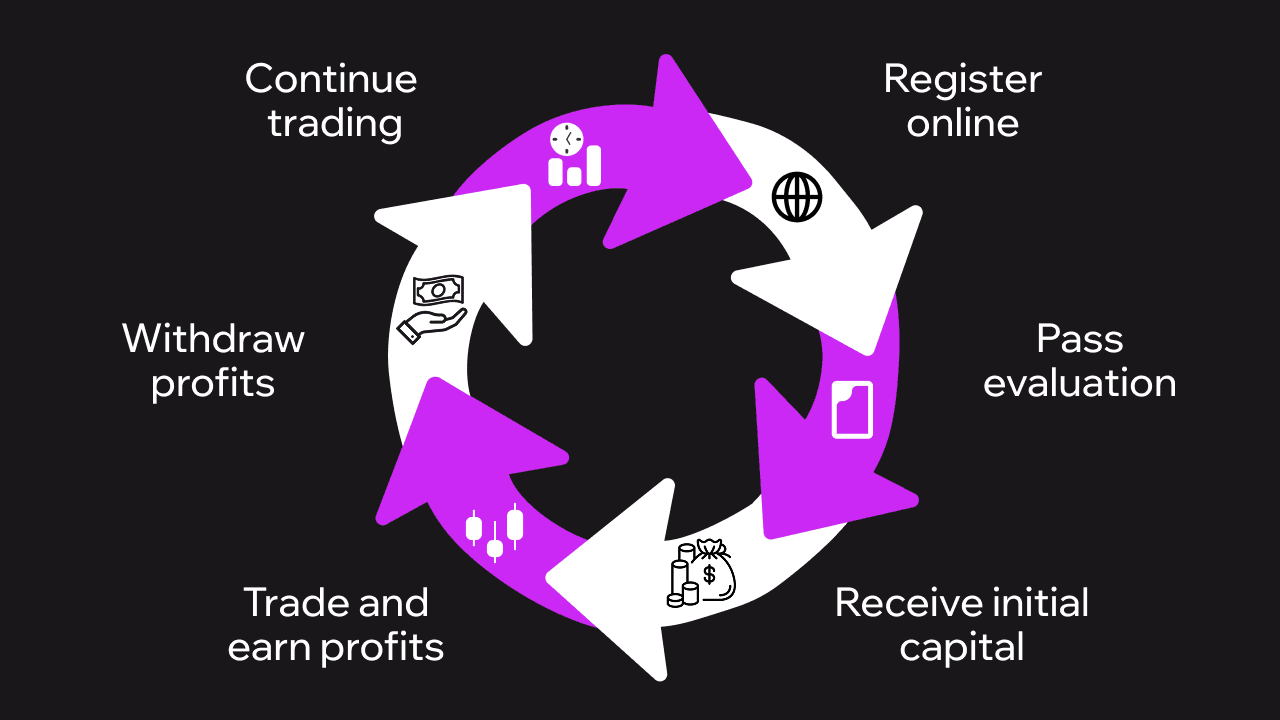

Upscale represents the evolution of secondary market access. Their Telegram-native platform serves 27,000+ active traders worldwide. Up to $200,000 capital access democratize professional trading. Visit Upscale.trade to experience next-generation prop trading.

Secondary market is where investors buy and sell securities efficiently. Liquidity enables quick position changes. Continuous trading maximizes profit opportunities for disciplined traders.

Types of Secondary Market Platforms in Modern Trading

Exchange platforms dominate secondary market trading. Centralized exchanges provide maximum liquidity. Decentralized platforms offer innovative features. Professional platforms integrate multiple venue access.

Stock exchange systems process millions of transactions daily. Cryptocurrency exchanges operate 24/7 continuously. Automated market makers provide constant liquidity. Order book systems match buyers with sellers.

Traditional exchanges require market makers. Digital platforms use algorithms extensively. Modern trading infrastructure combines best features from both worlds.

Features of the Secondary Market for Modern Assets

Secondary market features enable professional trading success. Continuous price discovery rewards skilled market analysis. Liquidity allows large position sizing. Regulation provides investor protection.

Key characteristics include transparent pricing mechanisms. Market hours vary by asset class. Volatility creates profit opportunities daily. 24/7 cryptocurrency trading expanded traditional market concepts.

Primary Market vs Secondary Market: Strategic Considerations for Traders

Strategic thinking separates successful traders from others. Primary market vs secondary market choice affects risk and return profiles significantly.

Primary market investments require longer holding periods. Secondary market enables quick profit realization. Liquidity differs dramatically between markets. Professional traders optimize for secondary market advantages.

Risk characteristics vary substantially between markets. Primary market offers potential upside from growth. Secondary market provides an established price history. Funded account traders typically focus on secondary markets.

Investment strategy determines market selection. Conservative approaches favor established securities. Aggressive strategies might include primary market allocation. Portfolio balance requires understanding both markets completely.

Investment strategy determines market selection. Conservative approaches favor established securities. Aggressive strategies might include primary market allocation. Portfolio balance requires understanding both markets completely.

Primary and Secondary Market Difference: Impact on Trading Returns

Primary and secondary market difference creates distinct return patterns. Timing and risk tolerance determine optimal market participation.

Primary market returns depend on company success over time. Secondary market returns reflect trading skill and market timing. Volatility patterns differ significantly between markets. Cryptocurrency markets amplified these traditional differences.

Return calculations vary between market types. Primary market uses buy-and-hold metrics. Secondary market employs active trading measures. Professional platforms optimize for secondary market performance tracking.

Risk-adjusted returns favor different approaches. Long-term investors might prefer primary market opportunities. Active traders excel in secondary market environments. Upscale's 80% profit sharing rewards secondary market trading excellence.

Advantages and Disadvantages of Primary Market Participation

Primary market advantages include early access to growing companies. Potential returns can exceed secondary market averages. Direct company interaction provides unique insights.

Disadvantages include limited liquidity options. Long holding periods may be required. Due diligence demands significant research time. Primary market success requires patience and expertise.

Risk assessment becomes crucial for primary market success. Information asymmetry favors professional investors. Regulatory requirements protect but limit access. Most prop traders avoid primary markets entirely.

Advantages and Disadvantages of Secondary Market Trading

Secondary market advantages dominate professional trading. Instant liquidity enables flexible position management. Transparent pricing eliminates guesswork. Continuous trading maximizes opportunity capture.

Market efficiency provides fair price discovery. Professional tools support decision-making. Advanced platforms like Upscale optimize secondary market advantages. Low fees maximize profit retention.

Disadvantages include market volatility stress. Competition from institutional players. Emotional trading destroys profits quickly. Technology requirements can be substantial.

Expert Tips for Successful Market Participation in Modern Trading

Professional market participation requires systematic approaches. Risk management determines long-term survival. Continuous learning adapts to changing conditions. Quality platforms amplify skill advantages.

Successful strategies focus on secondary market opportunities. Established assets provide better risk-reward profiles. Liquidity enables quick adjustments. Price transparency supports decision-making.

Key success principles include:

- Focus on liquid markets primarily

- Use proper position sizing always

- Implement stop-loss discipline consistently

- Diversify across uncorrelated assets

- Leverage professional tools effectively

- Maintain detailed trading records

Educational resources accelerate learning curves. Upscale provides comprehensive training for funded traders. Community support enhances individual performance. Technology integration streamlines execution processes.

The Future of Primary and Secondary Markets in Trading

Market evolution continues rapidly across all asset classes. Technology democratizes access to professional trading tools. Regulatory changes adapt to digital innovation. Cross-market integration increases efficiency.

Blockchain technology transforms traditional processes. Smart contracts automate primary market procedures. Decentralized finance creates new secondary market models. Innovation drives opportunity creation continuously.

Traditional and cryptocurrency markets converge gradually. Professional platforms prepare for integrated trading environments. Regulatory clarity improves market participation. Future success requires adaptation to changing landscapes.

Building Your Trading Future with Market Knowledge

Market mastery combines theoretical understanding with practical application. Primary market vs secondary market knowledge guides strategic decisions. Professional platforms provide implementation support.

Continuous learning drives trading success. Market knowledge compounds over time. Experience teaches lessons that theory cannot provide. Quality education accelerates the learning process.

Modern platforms like Upscale democratize professional trading access. Advanced tools level competitive playing fields. Community support accelerates individual growth. Start your journey with proper platform selection.

FAQ

What is the main difference between primary market and secondary market?

Primary market is where new securities are issued directly by companies to investors. Secondary market is where investors buy and sell existing securities among themselves. Primary creates, secondary trades.

How do primary and secondary markets affect prop trading strategies?

Prop traders focus mainly on secondary markets due to higher liquidity and established price patterns. Secondary markets provide better risk management and profit opportunities for funded accounts.

What are the key advantages of secondary market trading for funded traders?

Secondary market offers instant liquidity, transparent pricing, continuous trading opportunities, and established risk management tools. Professional platforms optimize these advantages for maximum profitability.

How can understanding primary markets help in evaluating trading opportunities?

Primary market knowledge helps identify quality assets entering secondary markets. Understanding company fundamentals from primary offerings improves secondary market trading decisions.

Which market offers better opportunities for prop traders - primary or secondary?

Secondary market provides superior opportunities for prop traders. Higher liquidity, better risk management, and continuous profit potential make secondary markets ideal for funded trading accounts.