What is XIRR: Formula, Calculation & Examples

What is XIRR: Formula, Calculation & Examples

Investment returns confuse many investors. XIRR solves this puzzle perfectly. This guide reveals everything about accurate return measurement. Master XIRR today for better investment decisions.

Understanding XIRR

XIRR means Extended Internal Rate of Return. What is XIRR? Think of it as your investment's true report card. XIRR meaning in mutual fund investing becomes your secret weapon.

Picture this: You're building a house brick by brick. Each brick represents an investment. Some bricks get added early. Others come later. Simple math treats all bricks equally. XIRR considers when each brick was placed.

The extended internal rate of return works like a smart calculator. It weighs every investment by its timing. XIRR provides honest answers about your money's growth.

Mutual fund investment portfolios love XIRR analysis. Crypto portfolio analysis needs this precision too. XIRR considers exact dates of each transaction. No guesswork involved.

Most investors use wrong calculators. They get false confidence from bad numbers. Understanding XIRR changes everything. XIRR is critical for smart money decisions.

XIRR provides a comprehensive view of performance. The concept of XIRR applies everywhere. Mutual funds, crypto, stocks --- all benefit. XIRR is accurate unlike simple math.

Ready to become an XIRR expert? Let's dive deeper into this powerful tool.

Why XIRR Matters More Than Simple Return Calculations

XIRR in mutual fund analysis reveals hidden truths. Simple math lies to investors. XIRR return tells the real story. Timing matters more than you think.

Imagine two friends investing in bitcoin. Friend A buys early when prices are low. Friend B waits until prices spike. Both end with the same profit amount. Simple math says they performed equally. XIRR shows Friend A's superior timing.

Crypto returns analysis faces timing nightmares. Cryptocurrency returns vary wildly by purchase date. DCA strategy creates multiple purchase points. Each purchase has a different growth time.

XIRR is accurate because it weighs timing properly:

-

SIP investment plans with monthly contributions

-

Multiple purchases during market volatility

-

Partial sales during investment periods

-

Crypto performance tracking with irregular buying

-

Mixed investment and withdrawal patterns

Stop fooling yourself with simple returns. XIRR provides honest performance measurement. Your future self will thank you.

XIRR helps avoid costly mistakes. The importance of XIRR grows with portfolio complexity. Smart investors always use XIRR for decisions.

The XIRR Formula and Mathematical Foundation

Now let's explore how XIRR actually works behind the scenes. Understanding mathematics helps you trust the results. Don't worry --- we'll keep it simple and practical.

Understanding How XIRR Works with Examples

XIRR accuracy shines through real examples. Let's compare methods side by side. XIRR example will shock you. SIP investment scenario reveals everything.

Calculate returns the wrong way first:

-

Monthly investment: $1000 for 12 months

-

Total invested: $12,000

-

Final value: $13,200

-

Simple return: 10%

Sounds good, right? Wrong! This ignores timing completely.

Calculate XIRR in mutual funds properly: Same investment, same final value XIRR calculation: 18.2% annually Huge difference! Early money had full year growth. Late money barely grew.

Crypto portfolio tracking shows similar patterns. Bitcoin at $30k, $40k, $50k creates timing effects. DCA XIRR calculation reveals true performance. Cryptocurrency returns need timing consideration.

XIRR provides honest answers. Mutual fund returns make sense with proper calculation. XIRR with an example proves timing matters hugely.

| Method | Result | Reality |

|---|---|---|

| Simple Math | 10% | Ignores timing |

| XIRR | 18.2% | Considers timing |

XIRR is a valuable tool for truth-seekers. Benefits of calculating XIRR include better decisions.

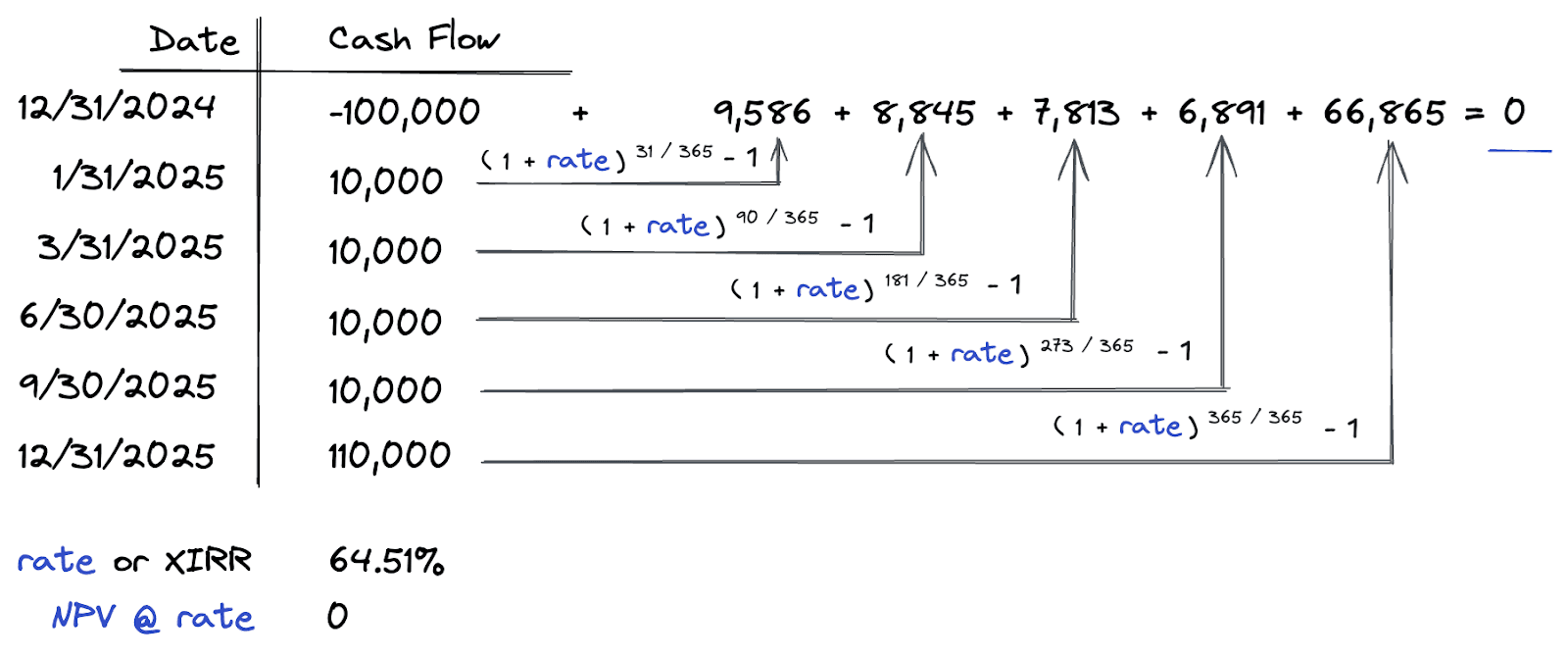

The XIRR Formula Explained

XIRR calculation formula looks scary but works simply. XIRR function finds the magic number. How XIRR works: mathematical precision meets practical needs.

XIRR formula: NPV = Σ (CFt / (1+r)^((dt-d0)/365)) = 0

Don't panic! Let's break this monster down:

-

CFt = cash flow amount

-

dt = transaction date

-

d0 = first transaction date

-

r = the rate we're hunting

XIRR function in Excel handles scary math automatically. Calculating XIRR in Excel becomes child's play. Computers do heavy lifting. You get accurate results.

Apply the XIRR formula principle everywhere. Each investment gets weighted properly. Computing XIRR manually takes forever. XIRR calculator tools save time.

Calculate the XIRR correctly every time. XIRR works through mathematical precision. XIRR offers superior accuracy for complex scenarios.

Think of XIRR as a detective. It investigates every cash flow. Timeline evidence matters most. Justice means accurate returns.

How XIRR Works in Mutual Fund and Crypto Investments

XIRR in mutual funds handles complexity beautifully. How XIRR works with SIP: timing rules everything. Mutual fund returns need proper weighting.

Investing in mutual funds creates cash flow events:

-

Monthly SIP contributions

-

Dividend reinvestments

-

Partial redemptions

-

Final portfolio liquidation

XIRR considers the timing of every event. Inflows and outflows affect calculations. XIRR varies based on transaction patterns.

XIRR in crypto follows identical rules. Crypto trading analytics demand timing precision. Bitcoin purchases at different prices need XIRR analysis. Crypto performance tracking reveals true results.

Investment period length affects XIRR stability. Longer periods smooth out volatility. XIRR indicates annualized performance accurately.

XIRR provides a comprehensive investment report card. Works in mutual funds and crypto equally. XIRR also works for stocks and bonds.

Ready to compare XIRR with other metrics?

XIRR vs. CAGR: Understanding the Critical Differences

Investors often confuse XIRR with CAGR. Both measure returns but serve different purposes. Learning when to use each metric prevents costly analysis mistakes. Let's clear up the confusion once and for all.

Key Differences Between XIRR and CAGR

The difference between XIRR and CAGR confuses many investors. What is XIRR and CAGR? Two different tools for different jobs. XIRR vs CAGR comparison reveals when each works best.

Compound Annual Growth Rate assumes one investment. CAGR ignores timing completely. Annual growth rate works for simple scenarios only. XIRR handles complex reality.

Picture building a tower:

-

CAGR: measures height from bottom to top

-

XIRR: considers when each floor was added

XIRR considers every cash flow individually. CAGR pretends money appeared magically. XIRR offers timing-aware analysis. CAGR stays timing-blind.

Investment returns measurement needs the right tools. Cryptocurrency returns often need XIRR. Bitcoin purchases happen irregularly. CAGR fails with multiple transactions.

| Aspect | XIRR | CAGR |

|---|---|---|

| Best for | Multiple investments | Single lump sum |

| Timing | Precise dates | Start/end only |

| SIP suitability | Perfect match | Completely wrong |

| Crypto trading | Essential | Useless |

| Complexity | Handles anything | Simple only |

Crypto markets demand XIRR precision. Crypto trading analytics require timing consideration. CAGR breaks with frequent transactions.

When to Use XIRR vs. When to Use CAGR

XIRR and CAGR serve different purposes. When to use XIRR: complex investment patterns. When to use CAGR: simple growth measurement.

Annual growth rate or CAGR works perfectly for:

-

One-time investments held long-term

-

Comparing fund performance over identical periods

-

Simple presentations to non-experts

-

Historical analysis without cash flows

-

Quick benchmark comparisons

Use XIRR when reality gets complex:

-

Systematic investment plan contributions

-

DCA strategy in crypto markets

-

Multiple purchase and sale dates

-

Dividend reinvestment scenarios

-

Trading performance with frequent transactions

Good XIRR in mutual funds needs XIRR calculation. SIP investment always requires XIRR. Crypto investments usually need XIRR too.

Stop using wrong tools. XIRR for complex scenarios. CAGR for simple ones. Choose wisely for accurate results.

Revolutionary Investment Analysis: The Upscale Trading Advantage

Technology transforms how we measure investment performance. Modern platforms integrate sophisticated analytics automatically. This revolution especially benefits crypto traders who deal with complex transaction patterns. Advanced tools make XIRR analysis effortless.

Modern Technology for Crypto Trading Performance Analysis

The investment analytics revolution transforms trading forever. Trading performance tracking becomes effortless. AI optimization eliminates calculation headaches.

Modern investment platforms integrate advanced metrics automatically. Performance tracking happens in real-time. Crypto trading analytics require specialized technology.

Enter Upscale - the game-changer in crypto prop trading. Visit Upscale.trade to experience the future. AI optimization calculates XIRR-equivalent metrics automatically.

Unique Telegram integration delivers performance updates instantly. Access up to $100,000 trading capital. XIRR-style analysis becomes more valuable with bigger capital. Transparent 80% profit sharing rewards accurate performance measurement.

Trading platforms evolution continues rapidly. Sophisticated analytics meet user-friendly design. Crypto performance tracking reaches new heights.

Performance tracking becomes your competitive advantage. Investment analytics separate winners from losers. AI optimization handles complex calculations perfectly.

Ready to join the revolution? Crypto trading analytics await your command.

Difference Between IRR and XIRR in Trading Context

IRR vs XIRR matters enormously in trading. Difference between IRR and XIRR: timing assumptions differ completely. Internal rate of return assumes uniform periods.

XIRR handles irregular timing perfectly. Multiple cash flows in trading need XIRR precision. Cryptocurrency trading involves frequent transactions. IRR breaks quickly with active trading.

Professional traders prefer XIRR for accuracy. XIRR extends IRR capabilities significantly. Excel handles both calculations. XIRR provides superior trading analysis.

Trading performance demands timing precision. Only XIRR delivers this accuracy. IRR becomes useless with complex patterns.

XIRR wins the trading battle decisively.

Calculating XIRR in Excel: Complete Guide

Ready to calculate XIRR yourself? Excel makes this process straightforward once you know the steps. Proper data preparation determines your success. Follow this guide to master XIRR calculations quickly and accurately.

Preparing Your Data for XIRR Calculation

XIRR data preparation determines success or failure. Excel data for XIRR needs perfect organization. Investment data organization requires attention to detail.

Timing of each investment must be recorded precisely. Dates drive XIRR calculations completely. Crypto transaction tracking demands similar care.

Perfect data structure requires:

-

Column A: Transaction dates in chronological order

-

Column B: Cash flows - negative for investments, positive for redemptions

-

Consistent date formatting throughout

-

Complete transaction history without gaps

-

Final portfolio value as last positive entry

Investment data organization prevents calculation disasters. Clean data produces reliable XIRR results. Garbage in, garbage out applies here.

Take time organizing data properly. Your future self will thank you.

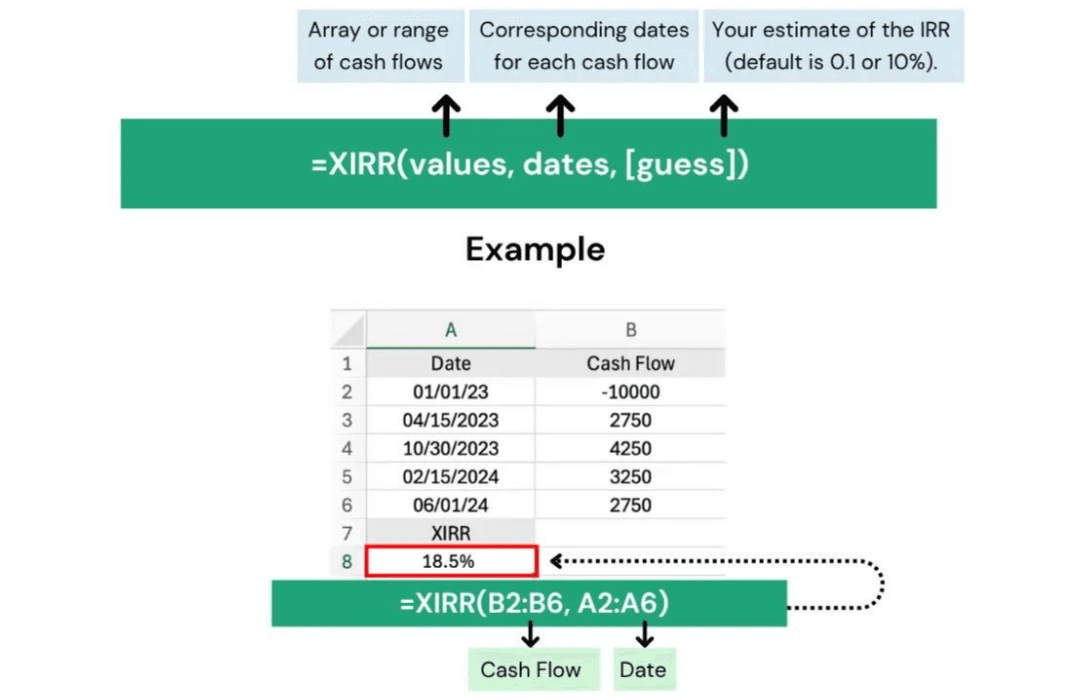

Using the XIRR Function in Excel Step-by-Step

How is XIRR calculated in Excel? XIRR in Excel uses built-in magic. Excel XIRR function handles complexity automatically.

XIRR formula in Excel: =XIRR(values, dates, [guess])

Step by step XIRR Excel process:

-

Enter cash flows in column A - investments negative, redemptions positive

-

Enter corresponding dates in column B

-

Select empty cell for XIRR result

-

Type =XIRR(A:A,B:B)

-

Press Enter for instant calculation

-

Result appears as decimal

-

Multiply by 100 for percentage

-

Format cell as percentage if desired

Excel XIRR function requires one positive and one negative cash flow minimum. Calculating XIRR in Excel becomes automatic once mastered.

Practice with simple examples first. Build confidence gradually. XIRR mastery awaits your dedication.

Common XIRR Calculation Mistakes to Avoid

XIRR calculation errors destroy accuracy completely. XIRR errors usually stem from data problems. XIRR mistakes include sign confusion and date formatting issues.

Deadly mistakes to avoid:

-

Wrong cash flow signs - investments must be negative

-

Inconsistent date formatting across entries

-

Missing transactions in calculation

-

Incorrect final valuation date

-

Circular reference errors in formulas

Calculate the return accurately by avoiding these traps. Double-check everything before calculating XIRR. XIRR provides accuracy only with perfect data.

Critical errors that destroy XIRR results:

⚠️ Using positive signs for investments

⚠️ Missing key transactions

⚠️ Wrong date formats

Perfect preparation prevents poor performance.

Interpreting XIRR Results for Investment Decisions

Calculating XIRR is just the beginning. Understanding what your results mean determines investment success. Different asset classes require different interpretation approaches. Context matters more than absolute numbers when evaluating performance.

What is a Good XIRR? Performance Benchmarks

What is a good XIRR depends on asset types. What is a good XIRR in mutual funds varies by category. XIRR performance benchmark provides context for evaluation.

Good XIRR ranges by investment:

-

Equity mutual funds: 12-15% annually rocks

-

Debt funds: 7-9% annually acceptable

-

Balanced funds: 10-12% annually solid

-

Crypto performance benchmarks: 20-50% annually possible but volatile

-

International funds: 8-12% annually reasonable

Investment performance needs appropriate comparison. Good XIRR in mutual funds beats inflation meaningfully. Bitcoin and cryptocurrency show higher volatility potential.

Market conditions affect XIRR expectations dramatically. Bull markets enable higher values. Bear markets reduce achievable returns everywhere.

Positive XIRR beats bank deposits easily. XIRR value above 15% in equity deserves celebration.

Context matters more than absolute numbers.

XIRR Interpretation Across Different Asset Classes

What is XIRR in mutual funds varies significantly by category. What is XIRR in MF depends on the underlying strategy. Asset class XIRR needs category-specific knowledge.

Equity mutual fund XIRR interpretation:

-

Above 15%: Outstanding performance deserving applause

-

12-15%: Solid performance worth continuing

-

8-12%: Average performance needing review

-

Below 8%: Poor performance requiring action

Crypto XIRR analysis shows different patterns:

-

Extreme volatility creates wild XIRR swings

-

Bitcoin may show 100%+ or -50% XIRR

-

Cryptocurrency timing effects get amplified

-

Digital assets need different expectations

Mutual fund evaluation needs peer comparison. SIP investments show more stable XIRR over time. Performance of your mutual fund improves with longer periods.

Annualised return smooths out short-term noise. Annualised rate of return provides cleaner comparison.

Advanced XIRR Applications and Analysis

Moving beyond basic calculations opens new possibilities. Real-world scenarios reveal XIRR's true power. Professional investors use XIRR for complex portfolio analysis. Understanding advanced applications elevates your investment decision-making significantly.

Real-World Investment Scenarios Using XIRR

What is XIRR in mutual fund practice? Let's see real examples. XIRR application reveals portfolio insights. Real world XIRR scenarios teach valuable lessons.

Case study one: SIP investment story

-

Monthly investment: $500 in equity fund

-

Investment period: 3 years

-

Market volatility: high during period

-

Simple return calculation: 8%

-

XIRR with an example: actual 11.5% annually

Crypto DCA analysis scenario reveals more:

-

Bitcoin purchases monthly for 24 months

-

Price range: $20,000 to $60,000 per bitcoin

-

Final portfolio: 40% higher than investment

-

XIRR calculation: 28% annually considering timing

Mutual fund investors benefit from XIRR precision. SIP timing effects become crystal clear. DCA strategy evaluation needs XIRR accuracy.

These examples show XIRR reveals the truth where simple math lies.

Try analyzing your own portfolio. XIRR helps uncover hidden patterns.

XIRR in Account Statements and Professional Reports

XIRR in account statements appears in quarterly reports. Mutual fund statement XIRR follows standardized methodology. Reading XIRR statements requires basic understanding.

The value of your investment includes XIRR by fund companies. Institutional calculations match personal ones with identical data. Professional reports emphasize XIRR for systematic investment plan evaluation.

Key statement areas worth attention:

-

XIRR calculation period and method

-

Fee and expense inclusion status

-

Benchmark XIRR comparison values

-

Personal calculation consistency check

Mutual fund companies highlight XIRR in marketing. The performance of your mutual fund gets measured using XIRR standards. Trust but verify their numbers.

XIRR provides standardized performance language. Everyone speaks the same measurement dialect.

XIRR Limitations and Alternative Metrics

No metric is perfect. XIRR has strengths and weaknesses like any analytical tool. Understanding limitations prevents misinterpretation. Smart investors use multiple metrics for complete analysis. Knowing when XIRR fails helps you choose better alternatives.

When XIRR May Not Be the Best Metric

XIRR limitations exist despite its power. Drawbacks of XIRR include timing sensitivity issues. XIRR disadvantages appear with irregular patterns.

Investment period effects can skew results. Short periods with large redemptions create misleading high XIRR. Crypto volatility considerations amplify timing effects dramatically.

Specific XIRR limitations include:

-

Extreme sensitivity to cash flow timing

-

Short period misleading results

-

Multiple XIRR solutions possible sometimes

-

Strategy comparison difficulties

-

Cryptocurrency volatility creates unrealistic values

Professional analysts use metric combinations. Investment returns evaluation needs comprehensive approaches. XIRR alone doesn't tell complete stories.

Negative XIRR can mislead during market downturns. Context always matters more than numbers.

Alternative Performance Metrics for Specific Scenarios

XIRR alternatives provide different performance perspectives. Other than XIRR metrics serve specific needs. Investment return metrics suite offers various options.

Mutual fund scheme evaluation uses multiple metrics:

-

Time-Weighted Return for manager evaluation

-

Money-Weighted Return similar to XIRR

-

Sharpe Ratio for risk-adjusted performance

-

Crypto performance metrics include volatility measures

-

Alpha and Beta for market-relative analysis

Professional analysis combines metrics strategically. No single measure provides complete pictures. CAGR remains valuable for simple growth measurement.

Crypto performance metrics include unique measures for digital assets. Blockchain technology enables new tracking methods.

Diversify your metric toolkit. Different tools for different jobs.

Understanding Negative XIRR Values

Negative XIRR indicates annualized investment losses. XIRR negative value reflects poor timing-adjusted performance. What does negative XIRR mean: your money lost value considering timing.

Investment loss scenarios create negative XIRR commonly. Bear market conditions produce negative returns. Crypto losses generate severely negative XIRR due to volatility.

Negative XIRR psychological aspects:

-

Natural panic and selling urges

-

Long-term perspective importance

-

Market cycle recovery patterns

-

Crypto markets show extreme swings

A professional negative XIRR approach involves cause analysis. Positive XIRR typically emerges with patience. XIRR varies based on market timing luck.

Negative XIRR teaches humility. Markets humble everyone eventually. Stay disciplined during tough times.

Mastering XIRR for Superior Investment Decisions

XIRR meaning encompasses accurate performance measurement universally. Investment decisions improve dramatically with proper XIRR analysis. XIRR mastery enables superior portfolio management.

Return on investment calculations become precise with XIRR. Crypto investment decisions benefit from timing-aware analysis. Traditional and digital assets both need sophisticated measurement.

XIRR mastery key takeaways:

-

XIRR is critical for systematic investment plan evaluation

-

Timing effects significantly impact returns

-

Simple returns mislead in complex scenarios

-

XIRR provides a comprehensive performance view

-

Multiple metrics enhance analysis quality

Benefits of calculating XIRR include accurate tracking and better decisions. The importance of XIRR grows with investment complexity. XIRR calculates true returns considering timing effects.

XIRR is a valuable tool for serious investors. XIRR also works across all asset classes. XIRR provides honest performance measurement.

Modern platforms like Upscale.trade incorporate sophisticated analytics. These platforms help users understand true performance. Professional crypto trading opportunities await with advanced analytical capabilities.

Start your XIRR journey today. Your portfolio deserves accurate measurement.

FAQ

How to calculate XIRR in mutual funds

Calculate XIRR in mutual funds using Excel XIRR function. Enter investment amounts as negative values. Add redemption value as positive. Include corresponding dates. Formula: =XIRR(cash_flows, dates).

What is a good XIRR in mutual funds

Good XIRR in mutual funds varies by category. Equity mutual funds: 12-15% annually excellent. Debt funds: 7-9% acceptable. Compare with peer funds and market conditions for context.

Why is XIRR more accurate than simple return calculations

XIRR provides a more accurate measurement because timing matters enormously. Simple returns ignore when investments occurred. XIRR considers every cash flow timing precisely. Timing effects significantly impact performance.

How does XIRR apply to cryptocurrency investments

XIRR in crypto handles multiple purchase dates perfectly. Cryptocurrency returns need timing consideration for accuracy. DCA strategy creates irregular investment patterns. XIRR provides precise crypto performance tracking results.