Intraday Trading: Strategies & Mistakes to Avoid

Intraday Trading: Strategies & Mistakes to Avoid

Master the art of quick profits. Learn proven strategies that work. Avoid costly mistakes that destroy accounts.

What is Intraday Trading and Why Traders Choose This Path

Intraday trading means buying and selling financial assets within the same trading day. No positions stay open overnight. Every trade closes before the market closes.

Think of it like surfing. You catch waves (price movements) and exit before the tide changes. The stock market opens at 9:30 AM. You buy Bitcoin at $45,000. You sell at $45,500 by 3:00 PM. That's intraday trading.

Why do traders love this approach? Freedom comes first. Trade from anywhere. Make money in minutes, not years. The intellectual challenge excites many. Markets become puzzles to solve daily.

Capital appreciation through intraday trading happens faster than traditional investing. Your money works harder. A 1% daily gain compounds to massive returns. Professional intraday traders often develop skills within 6-12 months.

Differences Between Intraday and Long-term Trading

Intraday trading relies on technical analysis. Long-term investing uses fundamental analysis. Day traders watch price charts. Investors study company financials.

Risk profiles differ completely. Intraday trading involves buying positions that last minutes or hours. Long-term trades span years. Psychological demands vary too. Day trading requires instant decisions. Investing needs patience.

Capital requirements show stark contrasts. Start intraday trading with $1,000. Build positions gradually. Long-term investing often needs larger initial amounts for diversification.

| Aspect | Intraday Trading | Long-term Trading |

|---|---|---|

| Analysis Type | Technical indicators | Fundamental research |

| Holding Period | Minutes to hours | Months to years |

| Decision Speed | Seconds | Weeks |

| Profit Target | 0.5-3% per trade | 10-30% annually |

| Risk Management | Stop-loss essential | Portfolio diversification |

Top-Performing Intraday Trading Strategies

These strategies guide traders through fast market changes. Each approach offers unique profit opportunities.

Momentum Trading: Capturing Strong Market Moves

Momentum trading exploits strong directional moves. Price breaks resistance. Volume surges. You enter immediately.

Professional momentum traders use specific indicators. Moving averages confirm trends. The ADX measures strength. Volume validates breakouts. RSI shows overbought conditions.

I once caught Tesla surging 8% intraday. Volume doubled normal levels. The 20-period moving average supported price. Entry at $720, exit at $775. Quick $5,500 profit on 100 shares.

False breakouts kill momentum traders. Wait for confirmation. Volume must exceed the 20-day average. Price should close above resistance. Never chase extended moves.

Reversal Trading: Finding High-Probability Turning Points

Reversal trading captures price rebounds. Markets overextend. Smart money enters opposite positions. Contrarian traders profit from extremes.

Successful reversal traders follow this process:

- Identify oversold RSI readings below 30

- Spot bullish divergence on indicators

- Watch for reversal candlestick patterns

- Confirm with volume increase

- Enter with tight stop-loss

- Target previous support levels

Risk management becomes critical here. You're trading against momentum. Position sizing stays smaller. Never average down on losing trades.

Breakout Trading: Capitalizing on Strong Market Moves

Breakout trading offers explosive profit potential. Price consolidates in ranges. Energy builds. Eventually, price explodes higher or lower.

Volume confirms genuine breakouts. Real breakouts show volume spikes 50% above average. False breakouts lack volume conviction. Wait for the retest of broken levels.

Triangle patterns work best for crypto breakouts. Bitcoin formed a symmetrical triangle in March. Breakout above $47,000 triggered entries. Volume tripled. The price reached $52,000 within hours.

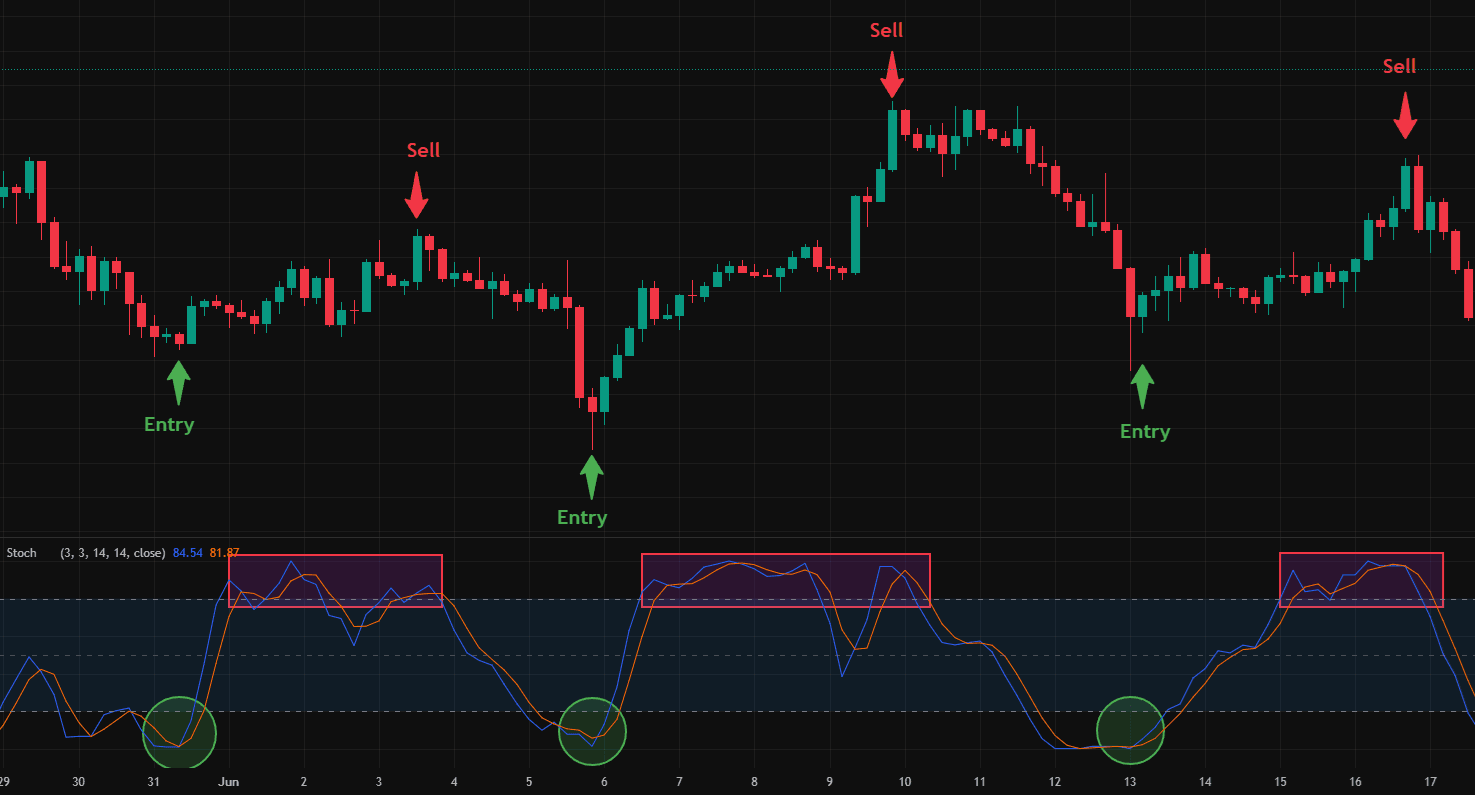

Range Trading: Profiting from Sideways Markets

Range trading works when trends disappear. Stocks oscillate between support and resistance. Buy the bottom, sell the top. Repeat until the range breaks.

Stochastic oscillators excel in ranges. Readings below 20 signal buys. Above 80 means sell. RSI provides similar signals. Combine both for confirmation.

Professional traders set alerts at range boundaries. No emotional decisions. Mechanical entries and exits. This strategy requires patience and discipline.

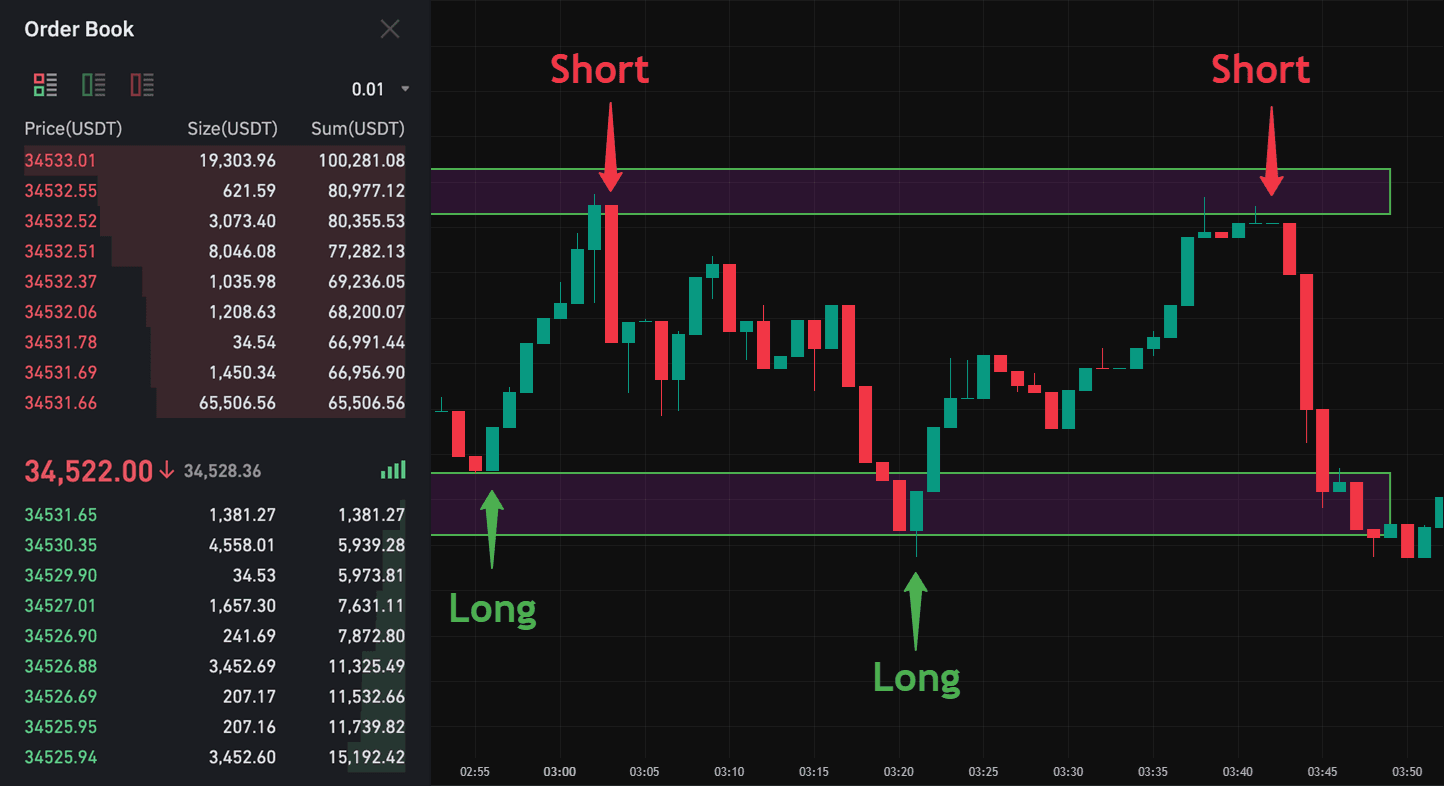

Scalping Strategies for Professional Traders

Scalping means taking small profits repeatedly. Trades last seconds to minutes. Target 5-10 pips or $0.10-0.20 moves. Volume matters more than size.

Successful scalpers use one-minute charts exclusively. They watch order flow. Market depth reveals supply and demand. Speed determines success.

Platform requirements include direct market access. Sub-second execution speeds. Hot keys for instant orders. Multiple monitors help track opportunities.

Stock Selection for Intraday Trading Success

Choosing the right stocks shapes intraday trading outcomes. Careful selection maximizes trading potential.

Essential Criteria for Stock Selection

The best stocks for intraday trading share common traits. Liquidity ranks first. You need easy entries and exits. Volume should exceed 1 million shares daily.

Volatility creates opportunities. Seek 2-3% daily ranges minimum. Too much volatility increases risk. Find the sweet spot.

Intraday stocks screening criteria:

- Average volume above 2 million shares

- Price between $10-500

- Beta between 1.2-2.5

- Spreads under $0.05

- News catalyst present

- Sector momentum positive

- Pre-market activity strong

- Options volume increasing

- Short interest moderate

- Technical setup clean

Finding the Sweet Spot: Volatility vs. Predictability

Balance matters in stock selection. High volatility means bigger profits. But it also means larger losses. Predictability reduces stress.

ATR (Average True Range) measures ideal volatility. Look for 2-4% daily ATR. Below 2% lacks opportunity. Above 4% becomes gambling.

Ethereum often provides perfect conditions. Daily moves of 3-5%. Predictable support and resistance. High liquidity ensures smooth execution.

Daily Trading Execution Framework

A structured routine supports consistent intraday results. Each stage strengthens trading discipline.

Pre-Market Analysis and Preparation

Professional trading starts before markets open. Wake at 6:00 AM. Coffee and charts by 6:30. News review completed by 7:00.

Essential pre-market checklist:

- Economic calendar events

- Overnight market movements

- Pre-market gainers/losers

- Support and resistance levels

- Volume unusual activity

- Sector rotation signals

- Correlation analysis

- Risk allocation plan

Mental preparation matters equally. Meditation clears the mind. Visualization improves execution. Review your trading rules. Set daily loss limits.

Professional Trade Execution Process

Entry signals must align perfectly. Price breaks resistance. Volume confirms. Indicators agree. Only then execute.

Position sizing follows the 2% rule strictly. $10,000 account risks $200 maximum. Stop-loss determines share size. Never violate this rule.

Use limit orders for entries. Market orders slip during volatility. Set orders slightly above the ask price. Ensures fills without chasing.

Exit strategies vary by market conditions. Partial profits at 1:1 risk-reward. Trail stops in strong trends. Time stops for non-performing trades.

Post-Market Analysis and Improvement

End each trading day with analysis. Review every trade taken. Screenshot setups for reference. Note emotions during trades.

Track these performance metrics daily:

- Win rate percentage

- Average winner size

- Average loser size

- Risk-reward achieved

- Maximum drawdown

- Emotional state score

Patterns emerge through consistent tracking. Maybe you trade poorly on Mondays. Or perform best during the first hour. Data reveals truth.

Technical Analysis Tools for Daily Success

Proper tools reveal hidden market opportunities. Smart analysis guides better trading.

Essential Technical Indicators

The best indicator for intraday trading combines simplicity with effectiveness. Moving averages provide trend direction. RSI shows overbought/oversold levels. Volume confirms everything.

VWAP (Volume Weighted Average Price) dominates institutional trading. The price above VWAP stays bullish. Below turns bearish. Most reversals happen at VWAP.

Combine three indicators maximum. More creates confusion. I use 20-EMA, RSI, and volume. Nothing else. Simplicity wins in fast markets.

Price Action Trading Fundamentals

Price action reveals market psychology. Candlestick patterns show buyer-seller battles. Pin bars indicate reversals. Engulfing candles confirm momentum.

Support and resistance form naturally. Previous highs become resistance. Old resistance becomes support. These levels attract orders.

One profitable pattern stands out. The "failed breakout" setup. Price breaks resistance. Immediately reverses. Traps breakout buyers. Short entry triggers. Quick profits follow.

Risk Management and Capital Protection

Protecting capital ensures long-term trading survival. Strong risk rules prevent losses.

The 2% Rule Implementation

Risk management separates professionals from gamblers. The 2% rule protects capital. Never risk over 2% per trade.

Calculate position size: Account: $10,000 Risk per trade: $200 (2%) Stop loss distance: $0.50 Position size: 400 shares ($200 ÷ $0.50)

This math becomes automatic. Preservation trumps profits. Survive first, thrive later.

Advanced Risk Management Techniques

Professional traders use multiple risk layers:

Per-trade risk: Maximum 2% loss Daily risk: Maximum 6% loss Weekly risk: Maximum 10% loss Correlation risk: Limit similar positions Time risk: Exit non-performing trades

These rules seem restrictive. They save accounts. One bad day won't end your career. Risk management enables longevity.

Markets and Instruments for Intraday Trading

Different markets offer unique profit potential daily. Selecting instruments shapes trading outcomes.

Stock Market Trading Opportunities

Stock markets offer unmatched liquidity. Trade major indices like SPY. Sector ETFs provide diversification. Individual stocks give maximum volatility.

Earnings season creates opportunities. Stocks move 10-20% on results. Pre-market shows direction. Volume confirms continuation.

Alternative Markets Overview

Forex markets trade 24/7. Major pairs offer tight spreads. EUR/USD moves predictably. Leverage amplifies returns and risks.

Cryptocurrency changed intraday trading forever. Bitcoin trades continuously. Volatility exceeds traditional markets. Weekend trading possible.

Futures provide leverage naturally. ES (S&P futures) tracks the index. Margin requirements stay low. Professional traders prefer futures.

Each market requires specialization. Master one before expanding. Jack of all trades masters none.

Technology and Trading Infrastructure

Thoughtful infrastructure supports efficient intraday trading. The right setup boosts results.

Essential Trading Setup Requirements

Your trading setup determines success potential. Reliable computer with 16GB RAM minimum. Dual monitors improve efficiency. Triple monitors are ideal.

Internet redundancy prevents disasters. Primary fiber connection. Mobile hotspot backup. Never lose connection during trades.

Platform choice matters immensely. TradingView for charting. ThinkOrSwim for execution. MetaTrader for forex. Choose based on markets traded.

Modern Trading Platform Innovations

Technology democratizes trading access. Mobile apps enable anywhere trading. AI analyzes patterns instantly. Automation handles routine tasks.

Telegram integration revolutionizes execution. Upscale's platform combines both seamlessly. Trade directly from Telegram. AI optimizes entries automatically. Learn more at Upscale.trade.

Cloud-based platforms eliminate hardware needs. Everything runs remotely. Access from any device. Scalability becomes unlimited.

Optimal Timeframes for Intraday Trading

The best time frame for intraday trading depends on strategy. Scalpers use 1-minute charts. Momentum traders prefer 5-minute. Range traders watch 15-minute.

Multiple timeframe analysis improves accuracy. Daily shows trend. Hourly identifies levels. 5-minute time entries.

Market sessions matter greatly. The first hour offers maximum volatility. Lunch hour slows down. Final hour sees position squaring.

Psychology of Successful Intraday Trading

Trading psychology determines long-term success. Fear causes premature exits. Greed delays profit-taking. Overconfidence increases position sizes. Doubt creates hesitation.

Emotional control techniques help. Deep breathing reduces stress. Preset rules remove decisions. Meditation improves focus. Exercise releases tension.

Develop pre-trade rituals. Review your plan. Visualize execution. Set alerts. Remove distractions. Enter flow state.

Recovery from losses matters most. Every trader faces drawdowns. Winners bounce back quickly. Losers spiral downward. Mental resilience separates them.

Building Consistent Profits in Intraday Trading

How to make money in intraday trading consistently? Focus on process, not outcomes. Perfect execution matters more than results. Profits within a single trading session follow naturally.

Track your expectancy:

(Win Rate × Average Win) - (Loss Rate × Average Loss) = Expectancy

Positive expectancy ensures long-term profits. Even 40% win rates work. If winners are larger than losers.

Beginner's Guide to Intraday Trading

Starting right is crucial for aspiring day traders. Solid groundwork builds confidence.

Learning Path for New Traders

Intraday trading for beginners starts with education. Read 10 trading books minimum. Watch successful traders. Join trading communities. Find mentors.

Paper trade for three months first. Test strategies risk-free. Make every mistake possible. Learn without losing money.

Start small when going live. Trade one share initially. Focus on execution, not profits. Increase size gradually. Build confidence through experience.

Your learning timeline:

- Month 1-3: Education and observation

- Month 4-6: Paper trading

- Month 7-9: Minimum size live trading

- Month 10-12: Gradual size increase

- Year 2: Consistent profitability

Common Trading Mistakes and How to Avoid Them

Many intraday traders fail from repeated errors. Overtrading destroys accounts fastest. Set trade limits. Three trades maximum until consistent.

Ignoring stop-losses ranks second. Pride prevents admitting mistakes. Losses grow exponentially. Always honor stops. No exceptions.

Revenge trading follows losses. Emotions override logic. Double-or-nothing mentality emerges. Step away after losses. Return tomorrow fresh.

Professional Trading Tips and Best Practices

Intraday trading tips from years of experience:

- Trade the same stocks daily for familiarity

- Never add to losing positions

- Take partial profits at targets

- Keep a trading journal religiously

- Review trades weekly for patterns

- Maintain life balance outside trading

- Network with successful traders

- Invest in continuous education

- Upgrade technology regularly

- Respect the market's power

Tips for intraday trading success: Develop unshakeable discipline. Follow rules mechanically. Emotions are your enemy. Consistency beats home runs.

Tax Implications for Active Day Traders

Tax on intraday trading varies by jurisdiction. Short-term capital gains apply. Rates equal ordinary income. Quarterly payments are often required.

Tax for intraday trading deductions include:

- Home office expenses

- Computer equipment

- Internet costs

- Platform subscriptions

- Education materials

- Trading courses

Maintain detailed records. Every trade must be documented. Consult qualified tax professionals. Rules change frequently.

Scaling Trading Success with Modern Prop Trading

Proprietary trading removes capital constraints. Trade firm money, not yours. Keep profit percentage. Zero personal risk.

Modern prop firms revolutionized access. Pass evaluation challenges. Receive funded accounts. Scale to millions potentially.

Profit sharing typically runs 70-90%. You keep the majority. Firms provide capital and infrastructure. Win-win arrangement.

- Benefits of prop trading:

- No personal capital risk

- Access to large accounts

- Professional tools included

- Mentorship opportunities

- Scaling potential unlimited

The Future of Intraday Trading

Intraday trading offers financial freedom. But success requires dedication. Master one strategy first. Build consistency gradually.

Technology keeps democratizing access. Barriers continue falling. Anyone can start intraday trading. Few will achieve mastery.

Your trading journey starts today. Begin with education. Practice relentlessly. Manage risk religiously. Success follows preparation.

FAQ

How do beginners enter the world of day trading?

Start with education through books and courses. Practice using demo accounts for three months. Begin with minimal capital and one strategy. Gradually increase position sizes as skills develop.

What dangers should traders anticipate in short-term trading?

Primary risks include overtrading, ignoring stop-losses, and emotional decisions. Market volatility can trigger large losses quickly. Technical failures and platform issues pose additional threats.

What capital amount enables effective day trading?

Begin with $1,000 minimum for stocks or $500 for forex. Pattern day trader rules require $25,000 for U.S. stocks. Cryptocurrency trading starts with any amount.