Scalping Trading: Strategy, Indicators & Tips

Scalping Trading: Strategy, Indicators & Tips

Scalp trading captures tiny profits from rapid price movements. Master this high-speed strategy for consistent gains. Learn proven techniques that professional scalpers use daily.

What is Scalping Trading?

Scalping trading means executing hundreds of trades daily for small profits. Scalpers buy and sell securities within minutes or seconds. This short-term trading style requires lightning-fast decisions and precise execution.

Think of scalp traders as digital sprint runners. Day traders might hold positions for hours. Scalpers exit positions in minutes. Quick profits accumulate through frequent trading throughout the day.

Scalping is a trading strategy that capitalizes on minor price fluctuations. Scalpers execute many trades seeking small price changes. Small gains multiply quickly with proper execution. Transaction costs must stay minimal for profitability.

Key takeaways for aspiring scalpers:

- Hold positions for seconds to minutes only

- Execute 50-200 trades per trading day

- Target 0.1-0.5% profit per trade

- Require real-time market data feeds

- Need strict exit strategy discipline

Key Characteristics of Scalping in Trading

Successful scalping requires specific market conditions and trader attributes. High trading volume ensures quick entry and exit points. Scalping relies on liquid markets with tight bid-ask spreads.

Scalp trading strategy demands lightning-fast execution speed. Price movements happen in seconds. Hesitation kills profits instantly. Technology becomes crucial for success.

Essential scalping characteristics include:

- Minimal exposure to the market per trade

- Focus on small price movements exclusively

- High-frequency decision making under pressure

- Advanced technical analysis and short-term indicators

- Understanding of market microstructure dynamics

- Ability to handle significant loss potential

- Mental stamina for intensive trading sessions

The Psychology of Successful Scalping

Scalp trading demands extraordinary mental discipline. Emotional control separates profitable scalpers from failing ones. Quick decision-making under pressure becomes second nature.

Many traders underestimate scalping psychology. Stress levels stay constantly elevated. Market exposure creates continuous tension. Successful scalpers develop systematic approaches to manage trading stress.

Professional scalpers maintain laser-sharp focus. Distractions destroy trading results immediately. Mental stamina must last entire trading days. Recovery between sessions prevents burnout completely.

Essential Tools for Scalping Trading

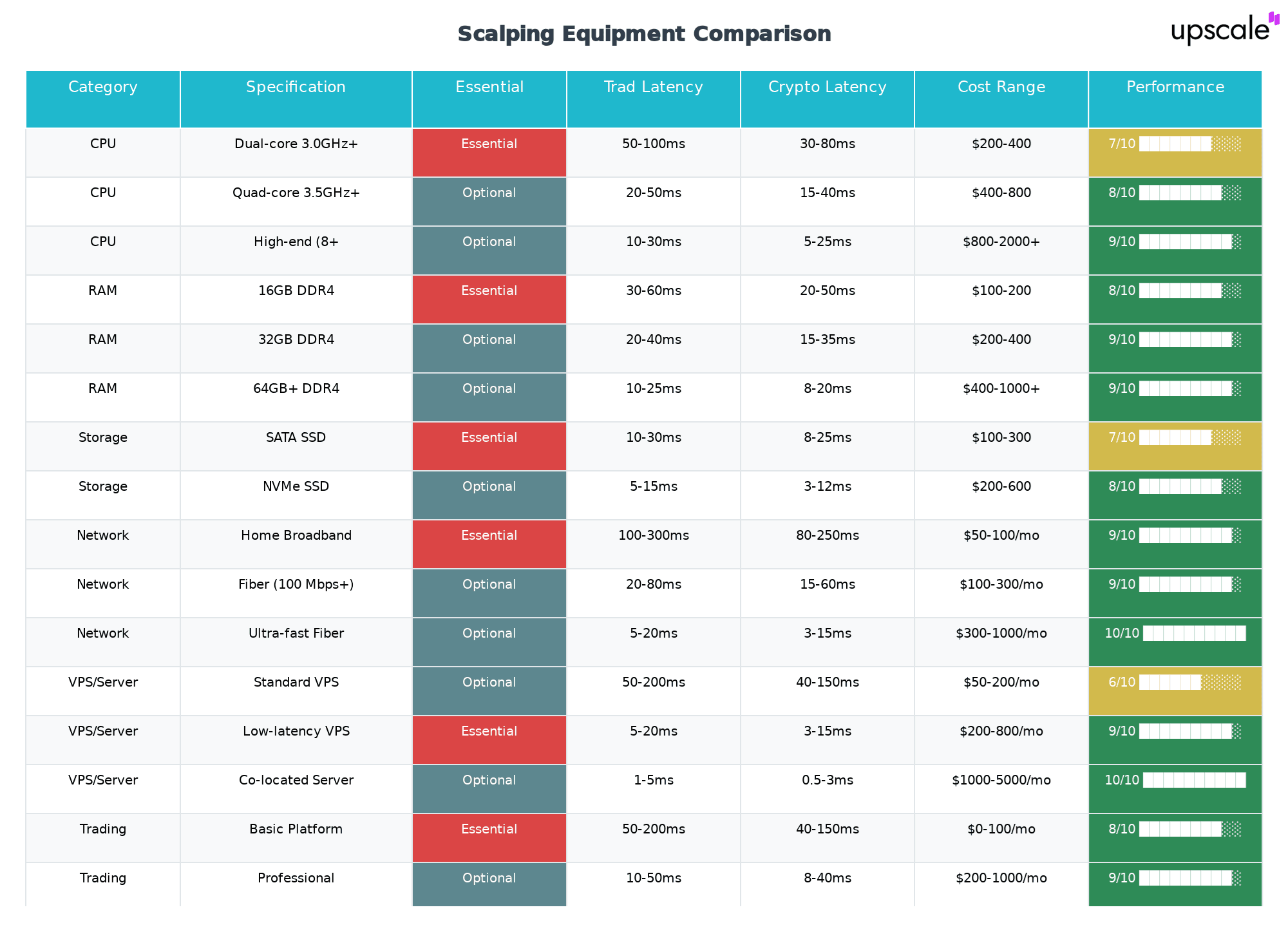

Technology drives scalping success in modern markets. Trading platforms must execute orders instantly. Real-time market data feeds provide crucial competitive advantages. Hardware specifications directly impact profitability.

Professional scalp traders invest heavily in infrastructure. Multiple monitors display different market views. High-speed internet connections prevent execution delays. Latency measurement becomes critical for consistent profits.

Software requirements include advanced charting capabilities. Level II data shows order flow patterns. Market scanners identify trading opportunities. Risk management tools protect capital automatically.

Software requirements include advanced charting capabilities. Level II data shows order flow patterns. Market scanners identify trading opportunities. Risk management tools protect capital automatically.

Choosing the Right Broker for Scalping

Broker selection determines scalping viability completely. Commission structures must favor high-frequency trading. Execution speed affects every single trade. Platform reliability prevents costly disconnections.

ECN brokers typically suit scalpers better than market makers. Direct market access provides faster fills. Scalping requires brokers who welcome frequent trading activity.

Evaluate brokers based on execution quality metrics. Slippage costs accumulate rapidly with volume. Order type availability enables advanced strategies. Upscale provides institutional-grade infrastructure for scalping across crypto and traditional markets.

Why Do Brokers Not Like Scalping?

Traditional brokers often restrict scalp trading activities. High trading volume strains their operational systems. Market maker brokers lose money on successful scalpers. Dealing desk models conflict with scalping strategies.

Scalpers create hedging challenges for brokers. Rapid position changes increase operational complexity. Revenue models favor longer holding periods. System resources get consumed by frequent orders.

Technical Analysis Tools for Scalping

Chart analysis drives scalping entry and exit decisions. One-minute timeframes reveal short-term price patterns. Technical indicators must respond quickly to price changes. False signals become expensive with frequent trading.

Successful scalpers master multiple timeframe analysis. Primary charts use tick or one-minute intervals. Higher timeframes confirm overall market trends. Combining indicators improves signal accuracy significantly.

Successful scalpers master multiple timeframe analysis. Primary charts use tick or one-minute intervals. Higher timeframes confirm overall market trends. Combining indicators improves signal accuracy significantly.

Volume analysis reveals market internals information. Price movements always need volume confirmation. Unusual volume spikes often precede profitable moves. Market depth data shows support resistance levels.

Common Scalping Trading Indicators

Moving averages smooth price action for trend identification. Short-period MAs react faster to price changes. Crossovers generate entry and exit signals. Exponential averages weigh recent prices more heavily.

RSI measures momentum in overbought oversold conditions. Relative strength index works well in range-bound markets. Divergences signal potential reversal points. Quick rebounds from extreme levels offer opportunities.

MACD combines trend and momentum analysis effectively. Signal line crossovers provide clear trading alerts. Histogram shows momentum strength changes. Bollinger Bands identify volatility expansions and contractions.

Essential scalping indicators include:

- 5 and 20-period moving averages for trend

- RSI with 14-period setting for momentum

- MACD with standard 12,26,9 parameters

- Volume indicators for confirmation

- Support resistance levels from price action

Proven Scalping Trading Strategies

Strategy selection depends on market conditions and personal trading style. Trend-following strategies work best in directional markets. Mean reversion approaches suit range-bound conditions. Multiple strategies provide diversification benefits.

Scalping is a trading strategy that requires constant adaptation. Market microstructure changes affect strategy performance. Successful scalpers maintain edge through continuous refinement. Backtesting validates strategy effectiveness across different periods.

Momentum-Based Scalping Strategy

Momentum strategies capture price acceleration in trending markets. Volume spikes confirm genuine breakout moves. Enter positions when price breaks significant levels. Exit quickly if momentum fades rapidly.

Price movements accelerate during momentum phases. News events often trigger momentum bursts. Technical breakouts create follow-through moves. Scalping requires perfect timing to capture these moves.

Implementation steps include:

- Identify high-volume price breakouts

- Enter positions in breakout direction

- Set tight stops below breakout levels

- Exit at predetermined profit targets

- Monitor volume for momentum continuation

Range Trading Scalping Strategy

Range-bound markets offer predictable scalping opportunities. Buy near support levels, sell near resistance. Mean reversion principles drive this approach. Overbought oversold conditions signal potential reversals.

Price fluctuations within established ranges create consistent profits. Support resistance levels act as profit targets. Strict exit discipline prevents range breakout losses. Position sizing remains conservative throughout execution.

Upscale stands among leading crypto prop trading firms providing advanced scalping infrastructure. Their platform offers multi-exchange connectivity and professional-grade execution tools. Access up to $100,000 capital with 80% profit sharing arrangements.

Risk Management in Scalping Trading

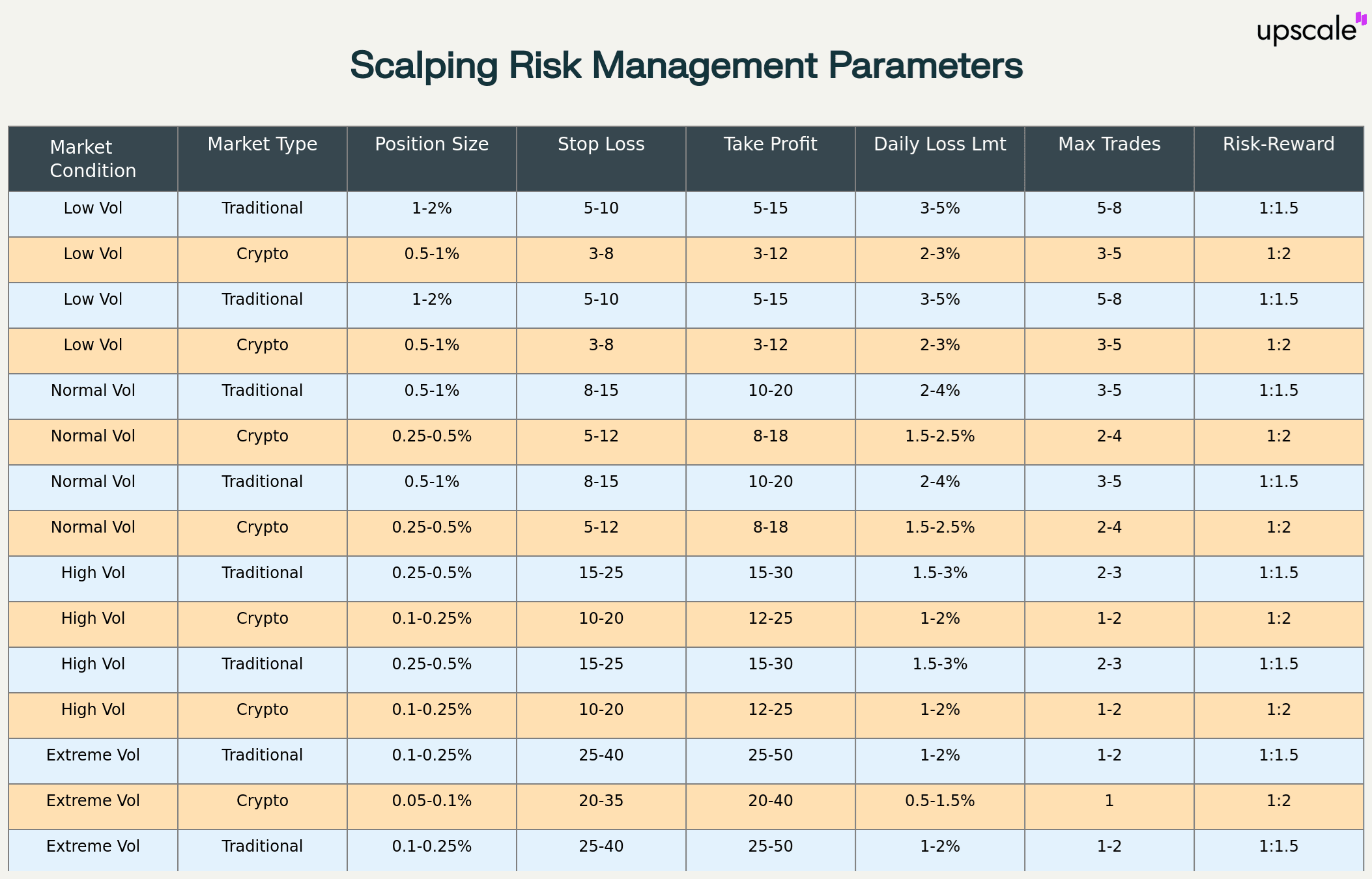

Risk management determines long-term scalping survival. Position sizing must account for frequent trades. Maximum risk per trade should never exceed 0.5%. Daily loss limits prevent catastrophic drawdowns.

Winning percentage requirements are higher in scalping. Transaction costs reduce profit margins significantly. Risk-reward ratios often favor smaller targets. Many small profits must offset occasional larger losses.

Winning percentage requirements are higher in scalping. Transaction costs reduce profit margins significantly. Risk-reward ratios often favor smaller targets. Many small profits must offset occasional larger losses.

Stop-loss placement requires precision timing. Too tight stops result in premature exits. Too wide stops violate risk parameters. Volatility-based stops adapt to market conditions automatically.

How to Choose Assets for Scalping

Asset selection criteria determine scalping opportunities. High trading volume ensures easy entry exit execution. Tight bid-ask spreads minimize transaction costs. Volatility creates profitable price movements consistently.

Stock selection focuses on large-cap liquid names. Market conditions affect asset suitability daily. Sector rotation creates new opportunities regularly. Crypto markets provide 24/7 scalping possibilities.

Screening criteria include:

- Average daily volume above 1 million shares

- Bid-ask spread under 0.05% consistently

- Price range $20-$200 for position sizing

- Clear technical patterns and levels

- News flow and event calendendar awareness

- Correlation analysis for portfolio effects

Real Scalping Trade Examples

Practice makes scalp trading profitable over time. Example trades demonstrate decision-making processes. Trade documentation improves future performance. Post-trade analysis identifies improvement areas.

Example momentum trade:

- Entry: $150.20 on volume breakout

- Stop: $149.95 (0.17% risk)

- Target: $150.55 (0.23% profit)

- Result: Stopped at target for 1.35:1 reward

Successful scalping depends on executing planned trades consistently. Emotional decisions destroy profitability quickly. Discipline separates successful scalpers from struggling traders.

How to Learn Scalping Trading Effectively

Systematic practice develops scalping skills progressively. Paper trading eliminates financial pressure initially. Demo accounts provide risk-free learning environments. Performance tracking identifies strengths and weaknesses.

Learning progression follows structured stages:

- Master basic technical analysis concepts

- Practice on trading simulators extensively

- Start with small position sizes

- Gradually increase complexity and size

- Develop personal trading rules

- Maintain detailed trading journals

Common Scalping Mistakes to Avoid

Overtrading destroys scalping accounts rapidly. Revenge trading after losses amplifies problems. Ignoring transaction costs eliminates profit margins. Platform limitations create execution problems.

Typical scalping errors include:

- Taking trades without clear signals

- Holding losing positions too long

- Inadequate position sizing discipline

- Insufficient market knowledge preparation

- Technology failures during active trading

- Emotional decision-making under pressure

Measuring Scalping Success

Performance measurement requires comprehensive analytics. Win rate must exceed 60% minimum. Profit factor should stay above 1.5 consistently. Average gain per trade covers all costs.

Key performance metrics include:

- Total return percentage

- Maximum drawdown periods

- Sharpe ratio calculations

- Win/loss ratio analysis

- Average holding period

- Commission cost percentage

Advanced Scalping Techniques

Professional scalpers employ sophisticated methodologies. Multiple timeframe analysis improves entry timing. Order flow trading reads market internals. Algorithmic assistance enhances manual decisions.

Advanced techniques include:

- Level II tape reading skills

- Market internals analysis

- Cross-exchange arbitrage opportunities

- Options flow integration

- Sector rotation timing

- Economic announcement strategies

Building Your Scalping Future

Scalping mastery requires dedication and continuous improvement. Market evolution demands strategy adaptation. Technology advances create new opportunities consistently.

Professional development never stops in scalping. Upscale provides comprehensive training and capital access. Visit Upscale.trade to explore professional scalping opportunities with institutional-grade tools and funding.

Professional development never stops in scalping. Upscale provides comprehensive training and capital access. Visit Upscale.trade to explore professional scalping opportunities with institutional-grade tools and funding.

FAQ

What is scalping trading?

Scalp trading involves making many trades throughout the day for small profits. Scalpers hold positions for minutes or seconds only. Strategy involves buying and selling securities rapidly based on minor price movements.

How does scalping trading work?

Scalpers profit from small price changes through high-frequency trading. They execute hundreds of trades seeking small gains. Profits accumulate through volume rather than individual trade size.

What are some effective scalping trading strategies?

Momentum and range trading represent core scalping approaches. Breakout strategies capture price acceleration. Mean reversion works in sideways markets. Multiple strategies provide diversification benefits.

What are the pros and cons of scalping trading?

Pros include quick profits and limited market exposure. Cons involve high stress levels and significant transaction costs. Success requires exceptional discipline and advanced technology infrastructure.

How to get started with scalping trading?

Start with paper trading and small positions. Master technical analysis and risk management first. Choose appropriate brokers and technology. Practice extensively before scaling up positions.