Money Market Instruments: Complete Guide to Short-Term Debt Securities

Money Market Instruments: Complete Guide to Short-Term Debt Securities

Money market instruments are short-term debt securities with maturities under one year. They provide high liquidity and extremely low risk for capital preservation. Three-pillar value proposition: time horizon under 1 year, very low risk with FDIC-insured options up to $250,000, returns of 2-4.5% annually.

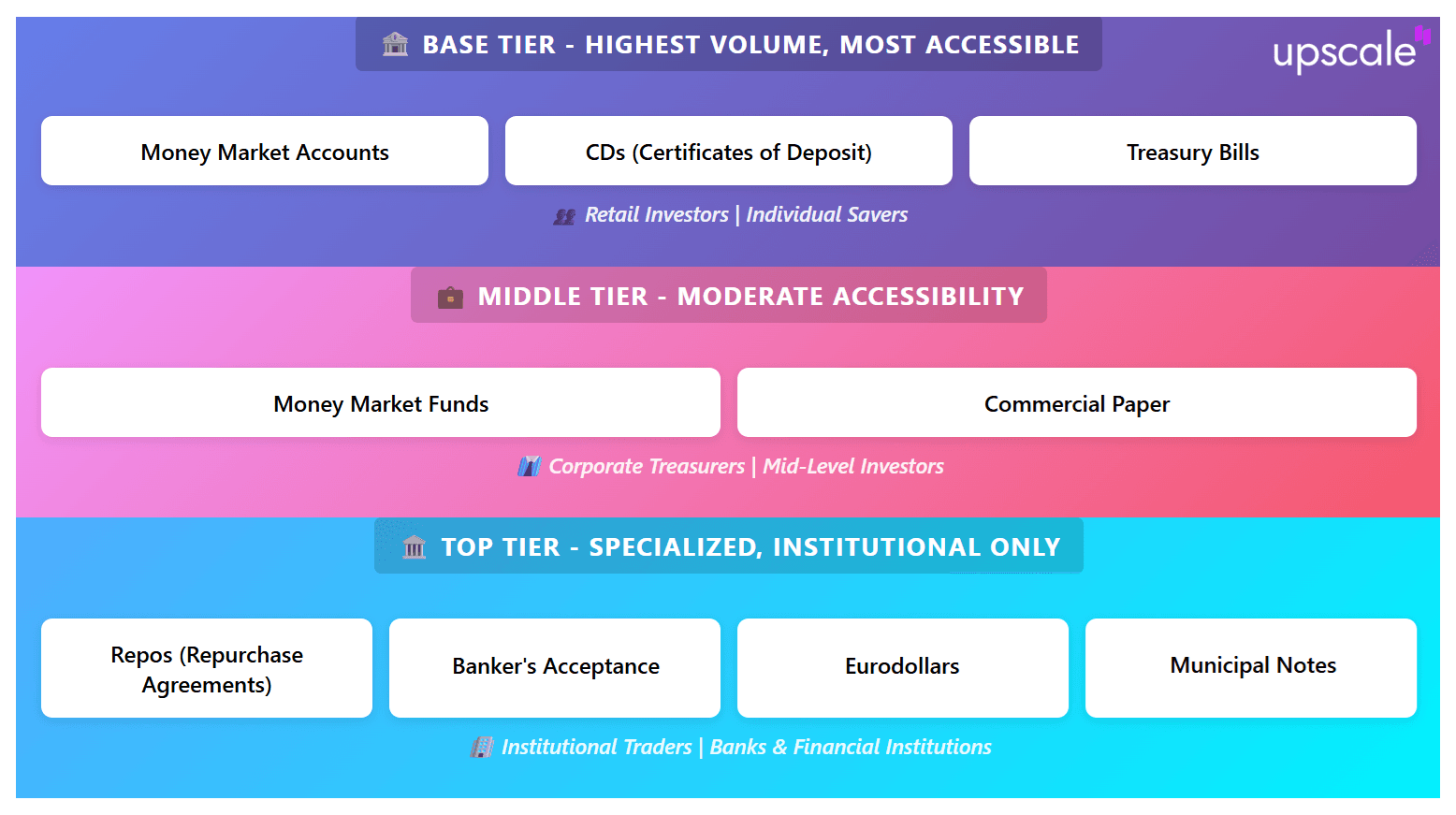

Nine instrument types serve different investor needs. Primary users include banks, corporations, governments, and individual investors. Each instrument balances safety, liquidity, and modest returns.

Think of money market instruments as parking spots for your cash. Safer than leaving it idle. More accessible than long-term investments. This guide explores characteristics, types, and strategic applications.

Core Characteristics of Money Market Instruments

Money market instruments share five defining attributes distinguishing them from capital markets.

Time Horizon

The one-year boundary separates markets fundamentally. Securities with maturities under 1 year qualify as money markets. Over 1 year becomes capital markets territory.

Range spans overnight repos to 364-day Treasury bills. A six-month CD qualifies as a money market instrument. Two-year CD crosses into capital markets classification.

Risk Level

Extremely low risk through multiple protections: FDIC insurance up to $250,000 per depositor for bank products, AAA/AA+ credit rating requirements for non-insured instruments, government backing for Treasury securities.

Default probability under 0.1% for AAA-rated instruments. Short maturity limits interest rate risk exposure. Government securities eliminate credit risk entirely.

Return Profile

Specify 2-4.5% annual returns currently. Often runs below inflation rates creating negative real returns. Trade-off for capital preservation and liquidity.

Concrete example: 4.40% money market account rates versus 0.5-1% traditional savings. Substantial improvement without sacrificing safety or access.

Liquidity

Highly liquid means exchangeable at short notice without penalties. Standard T+1 settlement provides next-business-day access. CDs impose early withdrawal penalties but most instruments remain penalty-free.

Quick access matters for emergency funds and operational cash needs. Deploy capital knowing withdrawal available if circumstances change.

Primary Users

Banks manage overnight liquidity via repos. Corporations fund short-term operations through commercial paper. Governments issue Treasury bills for budget timing needs.

Individual investors park emergency funds in money market accounts earning 4.40%+ with FDIC protection. Accessible returns without complexity or risk tolerance requirements.

Risk-return relationship favors preservation over growth. Compare against capital markets: short versus long maturity, low versus moderate-high risk, 2-4.5% versus 7-10% historical returns.

9 Types of Money Market Instruments

Nine distinct instruments provide options across risk tolerance, minimum investment, and liquidity preferences.

| Instrument | Maturity | Returns | FDIC Insured | Min. Investment | Best For |

|---|---|---|---|---|---|

| Money Market Funds | Overnight-1yr | 2-4% | ❌ | $1k-3k | Retail access |

| Money Market Accounts | Ongoing | 4.40% | ✅ | $1k-10k | Emergency fund |

| CDs (Certificates of Deposit) | 3mo-1yr | Up to 4.5% | ✅ | $500-5k | Fixed-term needs |

| Treasury Bills | 4wk-52wk | 4-5% | ❌ | $100 | Ultra-safe parking |

| Commercial Paper | 30d average | 4.5-5% | ❌ | $100k+ | Corporate funding |

| Banker's Acceptance | 30-180d | T-bill+20-40bp | ❌ | $100k+ | Trade finance |

| Repos (Repurchase Agreements) | Overnight | 4.5-5.5% | ❌ | Institutional | Interbank liquidity |

| Eurodollars | Various | T-bill+10-30bp | ❌ | Institutional | Offshore deposits |

| Municipal Notes | 3-12 months | 3.5% (tax-free) | ❌ | $5k-25k | High-income investors |

Notes:

- Returns approximate based on 2024-2025 rates

- FDIC covers up to $250,000 per depositor per insured bank

- bp = basis points (0.01%)

- T-bill = Treasury bill rate

Money Market Funds

Mutual fund structure investing in short-term debt maintaining $1.00 NAV per share. Daily portfolio valuation keeps NAV stable.

2008 Reserve Primary Fund "broke the buck" when Lehman Brothers exposure pushed NAV to $0.97. SEC reforms post-2008 strengthened protections.

Available through major brokerages. Minimums typically $1,000-$3,000. Not FDIC-insured but AAA credit quality requirements reduce risk.

Money Market Accounts

Bank savings product offering 4.40% versus 0.5-1% traditional savings. Maintains FDIC protection up to $250,000.

Withdrawal restrictions historically limited to 6 per month. Minimums typically $1,000-$10,000.

Ideal for an emergency fund. Example: $25,000 at 4.40% earns $1,100 annually versus $187.50 in savings at 0.75%.

Certificates of Deposit

Time deposit with fixed term and rate. Short-term CDs (3-6 months) qualify as money market instruments. Currently up to 4.5% for 6-month CDs.

Early withdrawal penalties typically equal 3-6 months interest. FDIC protection covers principal up to $250,000.

Use case: Known obligations with defined timing like wedding in 6 months or tax payment in 3 months.

US Treasury Bills

Short-term government debt with 4-week to 52-week terms. Full US government backing creates virtually risk-free status.

Purchase via TreasuryDirect.gov ($100 minimum), banks, brokerages. Currently 4-5% yields. State tax exemption improves after-tax returns.

Example: $100,000 in 26-week T-bills at 4.5% earns $2,250 with zero credit risk.

Commercial Paper

Unsecured promissory notes from corporations with average 30-day maturity. Requires AAA/AA+ credit ratings. Only top-tier issuers: Apple, Microsoft, JPMorgan.

Pays 20-50 basis points above T-bills (4.5-5% range). Minimum investments $100,000+ though money market funds provide retail access.

Corporate use: Company needs $50 million for 60 days at 4.8% versus bank credit at 6%.

Banker's Acceptance

Time draft guaranteed by bank for 30-180 days. Bank stamps "accepted" assuming payment obligation.

Primary use: international trade where parties lack trust. Trades at discount. Rates typically 20-40 basis points above T-bills. Declining usage as electronic alternatives emerge.

Repurchase Agreements

Short-term collateralized loan where party sells securities with simultaneous repurchase agreement. Typically overnight though can extend weeks.

Seller provides Treasury collateral (102-105% of loan). Bank A sells $100 million Treasuries to Bank B. Repurchases next day for $100 million plus interest (4.5-5.5%).

Institutional market. Retail investors access indirectly via money market funds.

Eurodollars

US dollar deposits held outside the United States. Exempt from Federal Reserve regulations. No FDIC insurance.

Rate premium 10-30 basis points versus T-bills. Primarily institutional investors and multinationals. The market developed 1950s-60s during Cold War.

Municipal Notes

Short-term debt from state and local governments with under 1-year maturity. Typically 3-12 months bridging seasonal cash flow.

Interest exempt from federal tax. 3.5% tax-free equivalent to 4.6-5.4% taxable for investor in 24-35% bracket.

Minimums $5,000-$25,000. Use case: High-income investor where 3.5% tax-free beats 4.5% taxable T-bill.

Money Markets vs Capital Markets

Clear boundary exists on time horizon, risk level, return expectations.

Time Horizon - Primary Distinction

Money markets are defined by under 1-year maturity. Capital markets exceed the 1-year threshold. A six-month CD qualifies as a money market. A two-year CD becomes capital market security.

Investors needing capital within 1 year use money markets. Multi-year horizons use capital markets accepting volatility for growth.

Securities Types

Money markets: Treasury bills, commercial paper, repos, short-term CDs, money market funds and accounts. All maintain under 1-year maturity.

Capital markets: stocks, long-term bonds, long-term CDs, equity mutual funds, REITs. Maturity exceeds 1 year or perpetual for equities.

Risk Levels

Money markets carry very low risk through short maturity and high credit quality with AAA/AA+ requirements, government backing, and FDIC insurance for bank products.

Capital markets range low to high risk. Bonds moderate risk. Stocks highest risk with 20-40% drawdowns during corrections.

Return Expectations

Money markets deliver 2-4.5% prioritizing capital preservation. Current environment competitive versus historical norms.

Capital markets provide 5-10%+ historical averages. Bonds 4-6%. Stocks 10% long-term average with substantial variation.

Who Uses Money Market Instruments

Four participant categories deploy instruments strategically.

Banks

Use repos for overnight liquidity. Bank with surplus lends via repo. Bank needing funds borrows against Treasury collateral. Federal Reserve repo facility provides system-wide backstop.

Corporations

Issue commercial paper for short-term funding. Apple issues a 60-day paper at 4.7% versus drawing credit at 6%. Must maintain AAA/AA+ ratings.

Invest excess cash in T-bills and money market funds optimizing returns on operating reserves.

Governments

US Treasury issues T-bills funding federal operations between tax receipts. State and local governments issue municipal notes for seasonal cash flow.

Individual Investors

Park emergency funds in money market accounts earning 4.40%+ with FDIC protection. Purchase T-bills for safe parking of larger sums. Build short-term savings in money market funds.

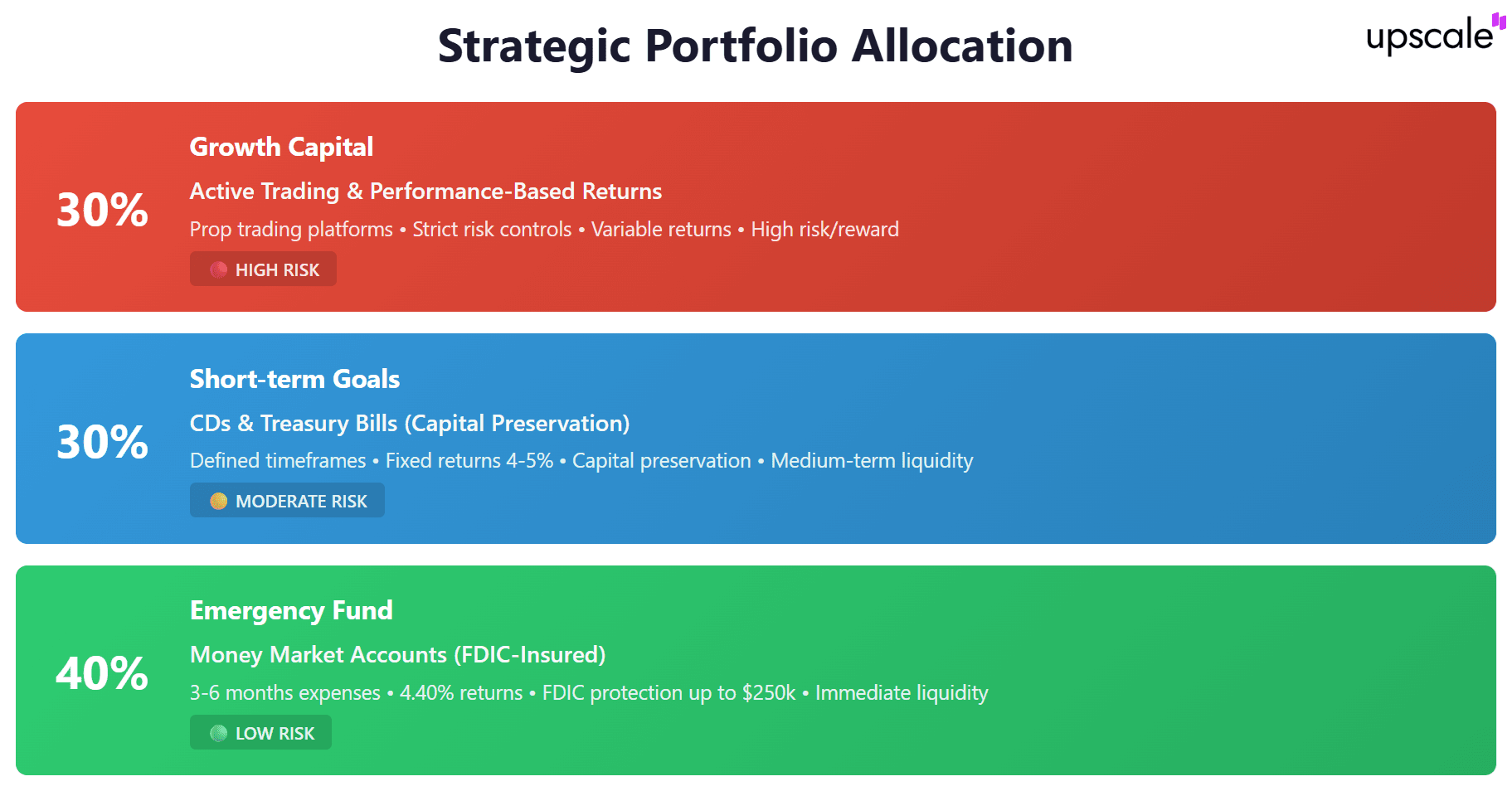

Growing Your Capital Beyond Money Markets

Money market instruments excel at preserving capital earning 2-4.5% with minimal risk. Once you've established your emergency fund foundation in these instruments, consider exploring active trading strategies for growth-oriented capital.

Visit Upscale.trade and pass our challenge to trade with funded capital up to $100,000. Over 200 trading instruments available. Transparent profit-sharing gives you 80% of gains. Strict risk management rules (5% daily drawdown, 10% total drawdown) develop institutional-grade discipline.

Consider a balanced approach: maintain 3-6 months expenses in FDIC-insured money market accounts for stability. Then explore growth potential through prop trading challenges. Our capital. Your skills. Shared profits.

Conclusion

Money market instruments create financial foundation through three pillars.

Characteristics define category: Time horizon (under 1 year), risk level (extremely low), return profile (2-4.5% currently), high liquidity (T+1 settlement standard).

Nine types provide options: Accessible options include money market accounts and funds ($500-$1,000 minimums). Treasury bills offer government backing. CDs provide FDIC insurance with fixed terms. Specialized instruments serve institutional needs.

Strategic application guides usage: Emergency fund core stores 3-6 months expenses. Short-term goal parking holds 1-6 month needs. Pre-investment staging optimizes returns while planning deployment. Surplus cash management earns returns on temporary balances.

Implementation framework: Calculate emergency need based on monthly expenses. Open a high-yield money market account or brokerage. Research fund options evaluating credit quality (85%+ AAA), expense ratios (under 0.25%), AUM ($500 million+). Start with a comfortable portion. Scale based on experience and confidence.

Money market instruments create financial foundation. Capital preserved. Liquidity maintained. Returns optimized within safety constraints. Foundation enables confident deployment of excess capital toward growth strategies.

FAQ

What are money market instruments?

Money market instruments are short-term debt securities with maturities under one year providing high liquidity and low risk. Nine main types include money market funds and accounts, CDs, Treasury bills, commercial paper, banker's acceptances, repos, eurodollars, and municipal notes. Used for capital preservation, emergency funds, and short-term cash parking earning 2-4.5% currently with varying FDIC insurance coverage depending on instrument type.

Are money market instruments high yielding?

No, money market instruments prioritize capital preservation and liquidity over high yields. Current returns range 2-4.5% annually depending on instrument type and market conditions. Money market accounts currently offer 4.40% while Treasury bills yield 4-5%. These returns often trail inflation creating negative real returns, but compensate through FDIC insurance (where applicable), virtually zero default risk, and immediate liquidity making them suitable for emergency funds and short-term needs rather than wealth building.

Is a CD a money market instrument?

Short-term CDs with maturities under one year qualify as money market instruments. Three to six-month CDs fall within money market classification. Longer-term CDs (2-year, 5-year, 10-year) cross into the capital markets category due to exceeding the one-year maturity threshold. The distinguishing factor is time horizon: under 1 year equals money market, over 1 year becomes capital market security regardless of other characteristics.

What is the difference between money markets and capital markets?

Primary distinction is time horizon: money markets involve securities maturing under 1 year, capital markets exceed 1 year. Money markets carry very low risk (AAA/AA+ ratings, government backing, FDIC insurance) delivering 2-4.5% returns with high liquidity. Capital markets range from moderate to high risk delivering 5-10%+ historical returns. Money markets preserve capital for short-term needs. Capital markets build wealth over multi-year periods accepting volatility.

Who uses money market instruments?

Four primary users: Banks manage daily liquidity via repos and Fed facilities. Corporations issue commercial paper for 30-270 day funding and invest excess cash in T-bills earning 4-5%. Governments issue Treasury bills and municipal notes bridging timing gaps between revenue and expenses. Individual investors park emergency funds (3-6 months expenses) in money market accounts earning 4.40% with FDIC protection, and purchase T-bills for safe parking of larger sums.

What does FDIC insurance cover for money market products?

FDIC insurance covers money market accounts and short-term CDs up to $250,000 per depositor per insured bank. Money market funds, Treasury bills, commercial paper, and other securities lack FDIC protection since they're not bank deposits. FDIC coverage extends to principal and accrued interest combined. Multiple banks allow coverage extension through account spreading. Government securities provide different protection: full faith and credit of the US government rather than FDIC insurance.